Printable Loan Agreement Document for California

In the realm of financial transactions, the California Loan Agreement form serves as a crucial document that outlines the terms and conditions governing a loan between a lender and a borrower. This form is designed to protect the interests of both parties, ensuring clarity and mutual understanding. It typically includes essential elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the agreement addresses potential fees, late payment penalties, and the rights and obligations of each party. By clearly delineating these aspects, the form aims to minimize misunderstandings and disputes that may arise during the loan period. Furthermore, it often incorporates provisions for default, allowing the lender to take appropriate action should the borrower fail to meet their obligations. With its structured approach, the California Loan Agreement form not only facilitates a smoother transaction but also fosters a sense of security for both the lender and the borrower.

More State-specific Loan Agreement Forms

Promissory Note Georgia - Understanding cloaked jargon in the Loan Agreement is crucial for effective decision-making.

To simplify the process of completing your Divorce Settlement Agreement, you can access resources and templates at Washington Templates, which can guide you in filling out the necessary information accurately and efficiently.

Promissory Note Template Florida Pdf - The form may clarify the role of guarantors if applicable.

Promissory Note Template New York - It often outlines the rights and obligations of both the lender and borrower.

Common Questions

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is provided between a lender and a borrower. It details the amount of the loan, the interest rate, repayment schedule, and any collateral involved. This form helps protect both parties by clearly defining their obligations and rights.

Who can use the California Loan Agreement form?

Any individual or entity looking to lend or borrow money in California can use this form. It is commonly utilized by private lenders, friends, family members, or businesses. However, it is essential that both parties understand the terms and are in agreement before signing.

What are the key components of a California Loan Agreement?

The key components typically include the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. Additionally, the agreement may specify the consequences of default and the rights of both parties regarding the loan.

Is it necessary to have the Loan Agreement notarized?

While it is not legally required to notarize a California Loan Agreement, doing so can add an extra layer of protection. A notary public verifies the identities of the signatories, which can help prevent disputes over whether the agreement was signed voluntarily.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take specific actions as outlined in the agreement. This may include charging late fees, accelerating the loan (demanding full repayment), or pursuing legal action to recover the owed amount. The exact consequences will depend on the terms set in the agreement.

Can the terms of the Loan Agreement be modified after it is signed?

Yes, the terms can be modified, but both parties must agree to any changes. It is advisable to document these modifications in writing and have both parties sign the revised agreement to avoid future misunderstandings.

What should I do if I have questions about the Loan Agreement?

If you have questions or concerns about a Loan Agreement, it is wise to consult with a legal professional. They can provide guidance tailored to your specific situation and help ensure that your interests are protected.

Are there any legal requirements for interest rates in California?

Yes, California law imposes limits on the interest rates that can be charged, particularly for consumer loans. It is crucial to be aware of these regulations to avoid potential legal issues. Consulting with a legal expert can help ensure compliance with state laws.

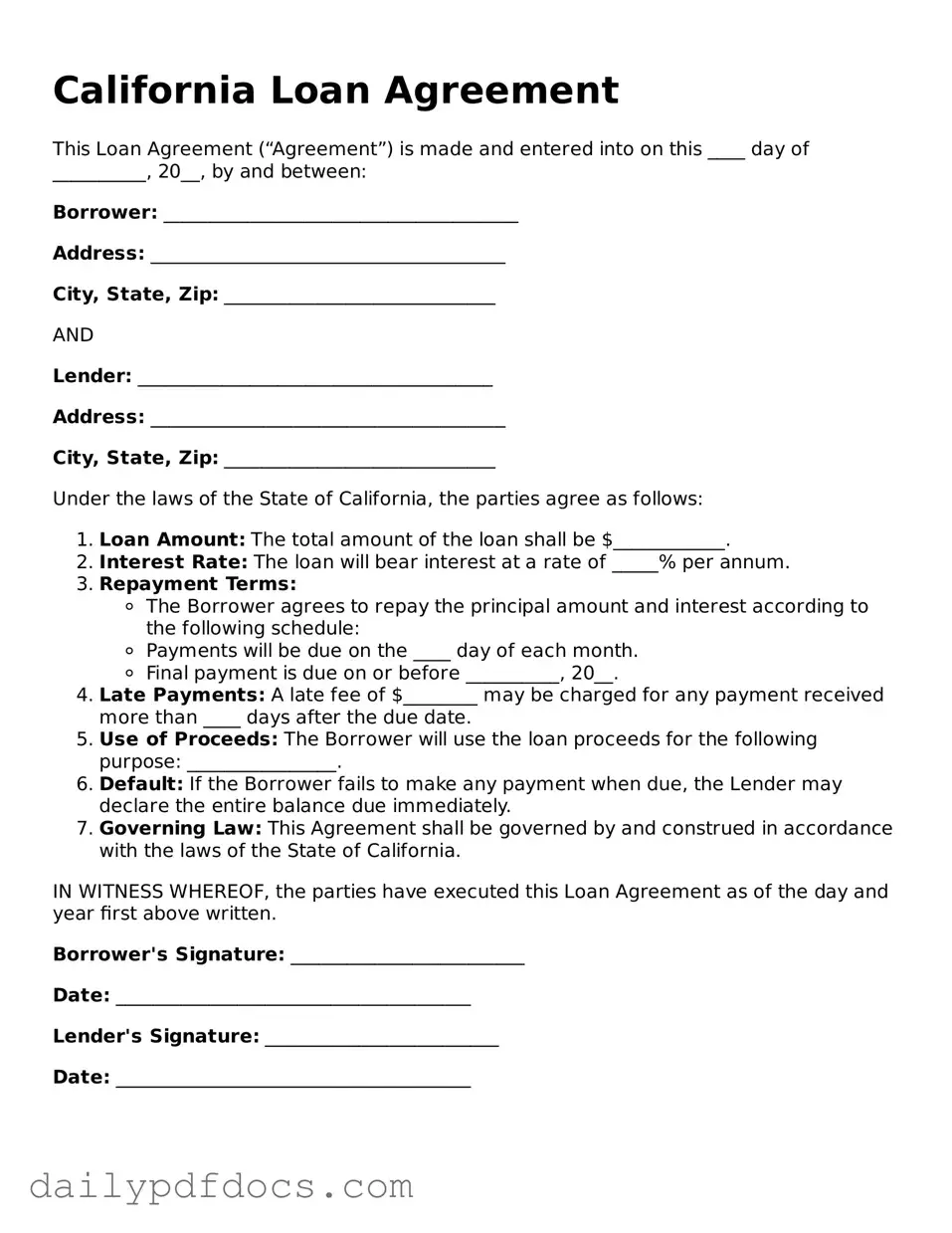

Preview - California Loan Agreement Form

California Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into on this ____ day of __________, 20__, by and between:

Borrower: ______________________________________

Address: ______________________________________

City, State, Zip: _____________________________

AND

Lender: ______________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Under the laws of the State of California, the parties agree as follows:

- Loan Amount: The total amount of the loan shall be $____________.

- Interest Rate: The loan will bear interest at a rate of _____% per annum.

- Repayment Terms:

- The Borrower agrees to repay the principal amount and interest according to the following schedule:

- Payments will be due on the ____ day of each month.

- Final payment is due on or before __________, 20__.

- Late Payments: A late fee of $________ may be charged for any payment received more than ____ days after the due date.

- Use of Proceeds: The Borrower will use the loan proceeds for the following purpose: ________________.

- Default: If the Borrower fails to make any payment when due, the Lender may declare the entire balance due immediately.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the day and year first above written.

Borrower's Signature: _________________________

Date: ______________________________________

Lender's Signature: _________________________

Date: ______________________________________

Similar forms

-

Promissory Note: This document outlines the borrower's promise to repay the loan, including the terms of repayment and interest rates. It serves as evidence of the debt.

-

Mortgage Agreement: Similar to a loan agreement, this document secures the loan with the property as collateral. It details the rights and obligations of both the borrower and lender.

-

Security Agreement: This document specifies the assets that are pledged as collateral for the loan. It ensures that the lender has a claim on the collateral if the borrower defaults.

-

Loan Application: This form collects information from the borrower regarding their financial status, which helps the lender assess creditworthiness before approving the loan.

- Marital Separation Agreement: For those navigating separation, the essential Marital Separation Agreement resources provide the necessary documentation to outline terms and facilitate the process.

-

Disclosure Statement: This document provides important information about the loan terms, fees, and conditions. It ensures transparency between the lender and borrower.

-

Loan Modification Agreement: If changes need to be made to the original loan terms, this document formalizes those adjustments, helping both parties agree on new conditions.

-

Guaranty Agreement: In this document, a third party agrees to take responsibility for the loan if the borrower defaults, adding an extra layer of security for the lender.

-

Forbearance Agreement: This document outlines a temporary postponement of loan payments, detailing the terms under which the borrower can defer payments without penalty.

-

Loan Repayment Plan: This document specifies the schedule and terms for repaying the loan, ensuring both parties have a clear understanding of payment expectations.

Misconceptions

Understanding the California Loan Agreement form is essential for anyone involved in lending or borrowing. However, several misconceptions often arise regarding this important document. Below are seven common misunderstandings, along with clarifications to help you navigate this process with confidence.

- Misconception 1: The Loan Agreement is not legally binding.

- Misconception 2: Only large loans require a written agreement.

- Misconception 3: Verbal agreements are sufficient.

- Misconception 4: The Loan Agreement does not need to be detailed.

- Misconception 5: Only banks and financial institutions use loan agreements.

- Misconception 6: The terms in a Loan Agreement are not negotiable.

- Misconception 7: Loan Agreements are only necessary for personal loans.

Many people believe that a loan agreement is merely a formality and lacks legal weight. In reality, a properly executed loan agreement is a legally binding contract that outlines the rights and obligations of both parties.

Some assume that only significant loans need to be documented. However, even small loans can benefit from a written agreement, as it helps clarify terms and prevent misunderstandings.

While verbal agreements can be made, they are difficult to enforce. A written loan agreement provides clear evidence of the terms and conditions, which is crucial if disputes arise.

Some believe that a simple agreement suffices. However, a comprehensive loan agreement should include details such as interest rates, repayment schedules, and any collateral involved to ensure clarity and protection for both parties.

This is not true. Individuals lending money to friends or family should also utilize a loan agreement. It can help maintain relationships by setting clear expectations.

Many people think that once a loan agreement is drafted, the terms are set in stone. In fact, both parties can negotiate terms before signing to ensure mutual agreement and satisfaction.

Some individuals believe that loan agreements are only relevant for personal loans. However, they are equally important for business loans and transactions, providing a clear framework for both parties involved.

By addressing these misconceptions, individuals can approach the California Loan Agreement form with a clearer understanding, ultimately leading to more secure and informed lending practices.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the California Civil Code, specifically sections related to contracts and loans. |

| Key Components | Essential elements include loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signature Requirement | Both parties must sign the agreement to make it legally binding. |

| Enforceability | If properly executed, the agreement is enforceable in a California court of law. |