Printable Gift Deed Document for California

In California, the Gift Deed form serves as an important legal tool for individuals wishing to transfer property without any exchange of money. This document allows a property owner to give real estate as a gift to another person, often a family member or close friend, while ensuring that the transfer is properly documented. The form includes essential details such as the names of the giver and recipient, a clear description of the property, and any conditions or restrictions associated with the gift. Additionally, the Gift Deed must be signed and notarized to be valid, providing an extra layer of protection for both parties involved. Understanding how to properly fill out and file this form is crucial for anyone looking to make a generous gesture that can significantly impact the recipient's financial future. By navigating the Gift Deed process correctly, you can ensure that the transfer of ownership is smooth and legally sound, avoiding potential disputes or complications down the line.

More State-specific Gift Deed Forms

What Is a Gift Deed - The donor must have lawful ownership to transfer the property via a Gift Deed.

In addition to the essential details described in the Florida Mobile Home Bill of Sale form, it is also important to reference reliable resources for proper documentation; for example, you can find a comprehensive template at mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale/.

How to Transfer Property Deed in Georgia - A Gift Deed can include specific terms regarding the property being gifted.

Common Questions

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one individual to another without any exchange of money. This deed is often used when a property owner wishes to gift their property to a family member or friend. It is important to note that the gift must be made voluntarily and without any expectation of receiving something in return.

What are the requirements for a valid Gift Deed in California?

To create a valid Gift Deed in California, several requirements must be met. The deed must be in writing and signed by the donor (the person giving the gift). It must clearly identify the property being transferred and the recipient (the person receiving the gift). Additionally, the deed should be notarized to ensure its authenticity. While not mandatory, it is advisable to record the deed with the county recorder’s office to provide public notice of the transfer.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. The donor may be subject to federal gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. However, gifts between spouses and certain educational or medical expenses may be exempt from this tax. The recipient of the gift may also face property tax reassessment. It is wise to consult a tax professional to understand the specific implications in your situation.

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and delivered, it generally cannot be revoked or changed. The act of gifting is considered a completed transaction. However, if the donor retains some control over the property or if the gift was made under duress or fraud, there may be grounds for legal action to contest the deed. It is crucial to ensure that the decision to gift is made freely and with full understanding.

What happens if the donor passes away after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the property typically remains with the recipient as long as the deed was properly executed and delivered. The property will not be included in the donor's estate for probate purposes. However, if the donor has other estate planning documents, such as a will or trust, those documents may also affect the distribution of assets. It is advisable to review all estate planning documents to ensure clarity.

Is it necessary to hire an attorney to create a Gift Deed?

While it is not legally required to hire an attorney to create a Gift Deed, it is often recommended. An attorney can help ensure that the deed is properly drafted, executed, and recorded. They can also provide guidance on any potential tax implications and help navigate any complexities that may arise during the process. Seeking legal advice can help prevent future disputes and ensure that the gift is valid and effective.

Preview - California Gift Deed Form

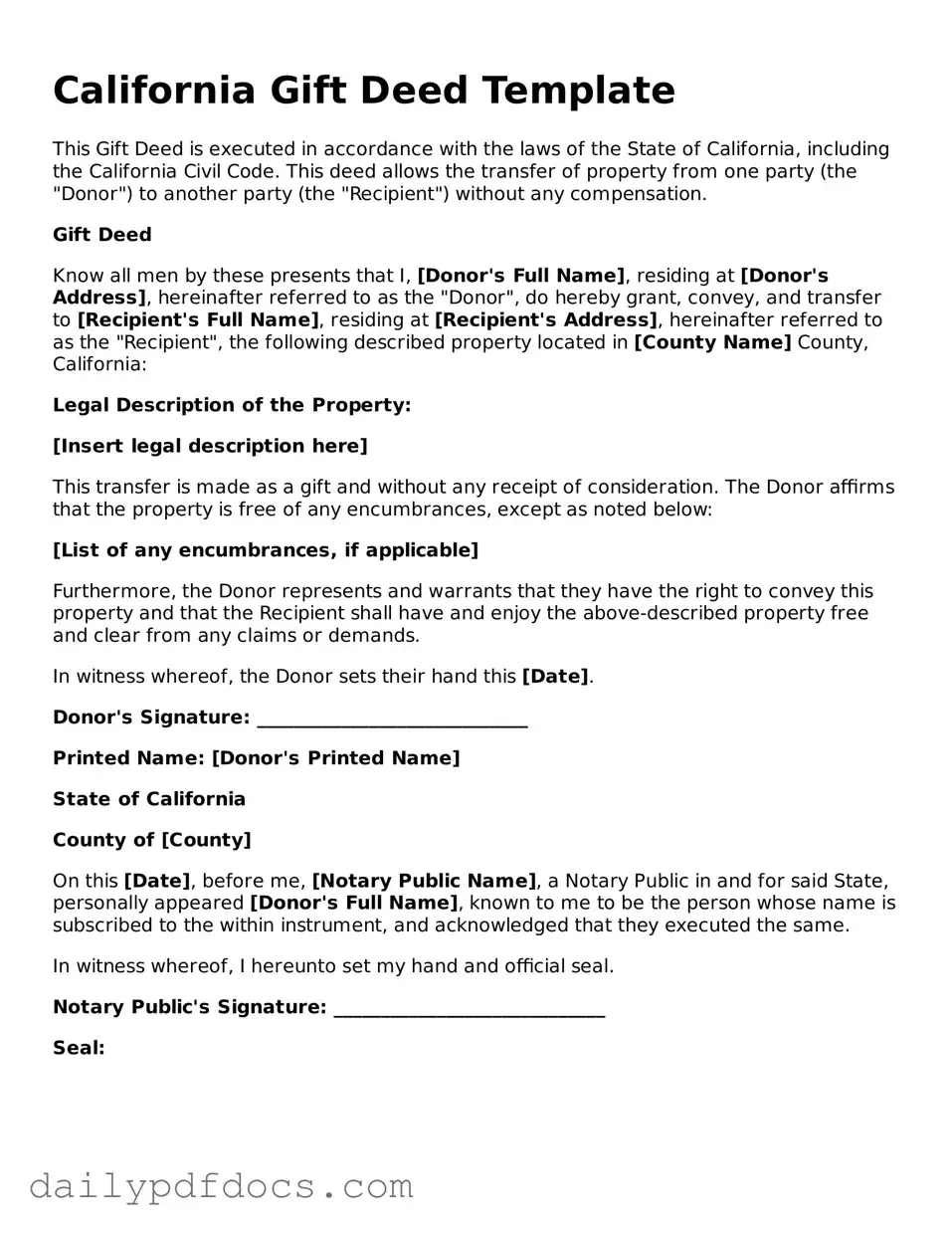

California Gift Deed Template

This Gift Deed is executed in accordance with the laws of the State of California, including the California Civil Code. This deed allows the transfer of property from one party (the "Donor") to another party (the "Recipient") without any compensation.

Gift Deed

Know all men by these presents that I, [Donor's Full Name], residing at [Donor's Address], hereinafter referred to as the "Donor", do hereby grant, convey, and transfer to [Recipient's Full Name], residing at [Recipient's Address], hereinafter referred to as the "Recipient", the following described property located in [County Name] County, California:

Legal Description of the Property:

[Insert legal description here]

This transfer is made as a gift and without any receipt of consideration. The Donor affirms that the property is free of any encumbrances, except as noted below:

[List of any encumbrances, if applicable]

Furthermore, the Donor represents and warrants that they have the right to convey this property and that the Recipient shall have and enjoy the above-described property free and clear from any claims or demands.

In witness whereof, the Donor sets their hand this [Date].

Donor's Signature: _____________________________

Printed Name: [Donor's Printed Name]

State of California

County of [County]

On this [Date], before me, [Notary Public Name], a Notary Public in and for said State, personally appeared [Donor's Full Name], known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: _____________________________

Seal:

Similar forms

Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only upon death, while a gift deed is immediate.

- Prenuptial Agreement: A prenuptial agreement is essential for couples to define their financial rights and obligations before marriage. It helps to prevent misunderstandings and promotes clear communication about assets, particularly when considering the use of forms like Ohio PDF Forms.

Trust Deed: A trust deed establishes a trust, allowing one party to hold property for the benefit of another. Both documents facilitate the transfer of property, but a trust deed often involves ongoing management of the property.

Sale Deed: A sale deed transfers ownership of property in exchange for payment. Both documents serve to transfer property, but a sale deed requires consideration (payment), whereas a gift deed does not.

Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. While both involve property use, a lease does not transfer ownership, unlike a gift deed.

Quitclaim Deed: A quitclaim deed transfers any ownership interest one person has in a property to another without guaranteeing that the title is clear. Similar to a gift deed, it conveys property rights but lacks the formalities of a gift.

Deed of Trust: A deed of trust secures a loan by transferring property to a trustee until the loan is repaid. While both involve property transfer, a deed of trust is typically used in financing scenarios.

Power of Attorney: A power of attorney allows one person to act on behalf of another regarding legal and financial matters. While not a property transfer document, it can facilitate the transfer of property, similar to a gift deed.

Partition Deed: A partition deed divides property among co-owners. Both documents involve the transfer of interests in property, but a partition deed is used specifically to resolve ownership disputes.

Assignment of Contract: An assignment of contract transfers rights and obligations from one party to another. Like a gift deed, it involves the transfer of interests, but it is typically used in contractual contexts.

Affidavit of Heirship: An affidavit of heirship establishes the heirs of a deceased person. While it does not directly transfer property, it can support the transfer of property rights, similar to a gift deed.

Misconceptions

Understanding the California Gift Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the California Gift Deed:

- Gift Deeds are only for family members. While many people use gift deeds to transfer property to relatives, they can also be used for friends or charitable organizations.

- Gift Deeds do not require any legal documentation. A gift deed must be properly drafted and executed to be valid. This includes signatures and, in some cases, notarization.

- There are no tax implications when using a Gift Deed. Although a gift deed may not trigger property tax reassessment, it can have gift tax implications for the giver.

- Once a Gift Deed is signed, the giver can change their mind. A gift deed is generally irrevocable once executed and delivered, meaning the giver cannot reclaim the property without the recipient's consent.

- Gift Deeds are the same as wills. A gift deed transfers ownership during the giver's lifetime, while a will only takes effect upon the giver's death.

- All properties can be transferred using a Gift Deed. Certain types of properties, like those with liens or mortgages, may have restrictions on being transferred as gifts.

- Gift Deeds can be used to avoid creditors. Transferring property via a gift deed does not protect the property from creditors if the giver is facing financial difficulties.

- Only real estate can be gifted using a Gift Deed. While primarily used for real estate, other types of property can also be transferred as gifts, but they may require different forms.

- Gift Deeds are a quick way to transfer property. Although they can simplify the process, proper legal procedures must still be followed, which can take time.

- Once a Gift Deed is filed, it cannot be contested. Gift deeds can be challenged in court under certain circumstances, such as claims of undue influence or lack of capacity.

Being aware of these misconceptions can help individuals navigate the complexities of property transfers in California more effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership without any exchange of money, typically as a gift. |

| Governing Law | The California Gift Deed is governed by the California Civil Code, specifically Sections 11911 to 11914. |

| Requirements | The deed must be signed by the donor and must be notarized to be valid. |

| Tax Implications | Gift deeds may have gift tax implications under federal law, depending on the value of the property transferred. |

| Recording | To ensure the transfer is legally recognized, the gift deed should be recorded with the county recorder’s office. |

| Revocation | Once executed and delivered, a gift deed generally cannot be revoked unless specific conditions are met. |