Printable Durable Power of Attorney Document for California

In California, a Durable Power of Attorney (DPOA) is a crucial legal document that empowers an individual to designate another person to manage their financial and legal affairs in the event of incapacity. This form allows the appointed agent to make decisions regarding property, finances, and other important matters, ensuring that the individual’s wishes are respected even when they cannot express them. The DPOA remains effective even if the person who created it becomes incapacitated, which distinguishes it from other types of power of attorney forms. It is essential to understand the scope of authority granted to the agent, as it can range from limited to broad powers. Additionally, the form must be signed and dated in the presence of a notary public or witnesses to ensure its validity. By preparing a Durable Power of Attorney, individuals can maintain control over their affairs and provide peace of mind for themselves and their loved ones, knowing that their interests will be protected when they are unable to act on their own behalf.

More State-specific Durable Power of Attorney Forms

Durable Power of Attorney Form Florida - Your agent can make healthcare decisions for you if specified, in addition to financial ones.

Power of Attorney in Ohio Requirements - The powers granted can be broad or limited, based on your preferences.

Durable Power of Attorney Form Pa - It is important to review and update the document as your situation changes.

Common Questions

What is a Durable Power of Attorney in California?

A Durable Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to manage their financial or medical affairs. This document remains effective even if the principal becomes incapacitated.

Why should I create a Durable Power of Attorney?

Creating a Durable Power of Attorney ensures that someone you trust can make important decisions on your behalf if you are unable to do so. This can help avoid confusion and delays in managing your affairs during a difficult time.

Who can be an agent in a Durable Power of Attorney?

In California, any competent adult can be appointed as an agent. This includes family members, friends, or professionals. It’s important to choose someone who understands your wishes and can act in your best interest.

Does a Durable Power of Attorney need to be notarized?

Yes, in California, a Durable Power of Attorney must be signed in front of a notary public or witnessed by two individuals who are not named in the document. This helps verify the identity of the principal and ensures the document is legally binding.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant financial institutions or healthcare providers.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy and costly, and it may not reflect your wishes.

Can I limit the powers of my agent in a Durable Power of Attorney?

Yes, you can specify the powers you want to grant to your agent. You may choose to give them broad authority or limit their powers to specific tasks, such as managing bank accounts or making healthcare decisions.

How does a Durable Power of Attorney affect my healthcare decisions?

A Durable Power of Attorney can include provisions for healthcare decisions, allowing your agent to make medical choices on your behalf if you are unable to communicate your wishes. This is often referred to as a Durable Power of Attorney for Health Care.

Is a Durable Power of Attorney the same as a Living Will?

No, a Durable Power of Attorney and a Living Will are different documents. A Durable Power of Attorney allows someone to make decisions for you, while a Living Will outlines your wishes regarding medical treatment and end-of-life care. It’s advisable to have both documents for comprehensive planning.

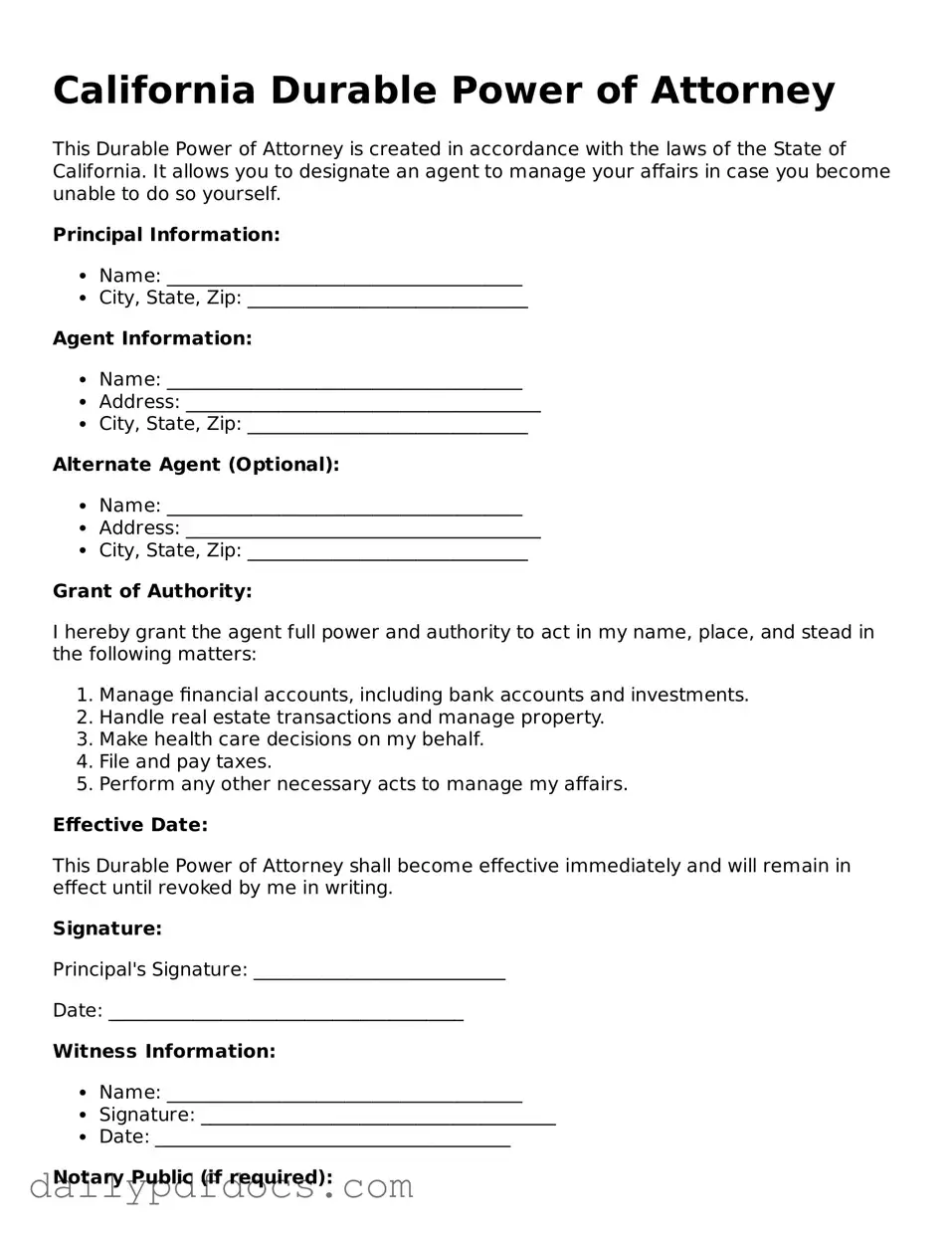

Preview - California Durable Power of Attorney Form

California Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of California. It allows you to designate an agent to manage your affairs in case you become unable to do so yourself.

Principal Information:

- Name: ______________________________________

- City, State, Zip: ______________________________

Agent Information:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

Alternate Agent (Optional):

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

Grant of Authority:

I hereby grant the agent full power and authority to act in my name, place, and stead in the following matters:

- Manage financial accounts, including bank accounts and investments.

- Handle real estate transactions and manage property.

- Make health care decisions on my behalf.

- File and pay taxes.

- Perform any other necessary acts to manage my affairs.

Effective Date:

This Durable Power of Attorney shall become effective immediately and will remain in effect until revoked by me in writing.

Signature:

Principal's Signature: ___________________________

Date: ______________________________________

Witness Information:

- Name: ______________________________________

- Signature: ______________________________________

- Date: ______________________________________

Notary Public (if required):

State of California, County of ________________

Subscribed and sworn to before me this _____ day of ____________, 20__.

Notary Public Signature: ______________________________

My Commission Expires: _____________________________

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, a General Power of Attorney allows an individual to appoint someone else to make decisions on their behalf. However, the General Power of Attorney typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This document specifically grants authority to a designated person to make medical decisions for someone if they are unable to do so. It focuses solely on healthcare matters, unlike the Durable Power of Attorney, which can cover a broader range of financial and legal decisions.

- Non-disclosure Agreement (NDA): A critical document for maintaining confidentiality in business relationships, a Washington Non-disclosure Agreement ensures that sensitive information shared between parties is protected. For more information and to fill out the NDA form, visit Washington Templates.

- Living Will: A Living Will outlines an individual’s wishes regarding medical treatment in situations where they cannot communicate. While it does not appoint someone to make decisions, it complements the Healthcare Power of Attorney by providing guidance on the principal's preferences.

- Revocable Trust: A Revocable Trust allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. While it serves a different purpose, it offers a way to manage affairs that can be similar to the authority granted by a Durable Power of Attorney.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) form is crucial for effective planning. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this important legal document.

- Misconception 1: A Durable Power of Attorney is only for the elderly.

- Misconception 2: A DPOA takes away your rights.

- Misconception 3: A DPOA is only effective after you become incapacitated.

- Misconception 4: The agent must be a lawyer or a professional.

- Misconception 5: A DPOA is the same as a living will.

- Misconception 6: Once created, a DPOA cannot be changed.

- Misconception 7: The DPOA expires after a certain period.

- Misconception 8: You cannot use a DPOA if you move to another state.

This is not true. Anyone, regardless of age, can benefit from having a DPOA in place. It allows individuals to designate someone to make decisions on their behalf if they become unable to do so.

In reality, a DPOA grants authority to another person but does not strip you of your rights. You can still make decisions for yourself as long as you are capable.

This is incorrect. A Durable Power of Attorney can be effective immediately upon signing, depending on how it is drafted.

While you can choose a lawyer as your agent, it is not a requirement. You can appoint a trusted friend or family member.

A DPOA and a living will serve different purposes. A DPOA focuses on financial and legal decisions, while a living will addresses healthcare preferences.

This is false. You can revoke or modify your DPOA at any time, as long as you are mentally competent.

A Durable Power of Attorney remains in effect until you revoke it, or you pass away, unless specified otherwise in the document.

While laws vary by state, many states recognize DPOAs created in California. However, it is advisable to check the specific laws in your new state.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make decisions on your behalf if you become unable to do so. |

| California Law | This form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | The "durable" aspect means the power of attorney remains effective even if you become incapacitated. |

| Agent Authority | The person you appoint, known as your agent, can manage your financial and legal affairs. |

| Revocation | You can revoke the Durable Power of Attorney at any time as long as you are mentally competent. |

| Signing Requirements | The form must be signed by you and witnessed by at least one person or notarized. |