Printable Deed in Lieu of Foreclosure Document for California

The California Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows a borrower to voluntarily transfer the title of their property to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By opting for this arrangement, homeowners can mitigate the impact on their credit score and potentially negotiate more favorable terms with their lender. The form outlines the responsibilities of both parties, including the condition of the property and any existing liens. It is essential for homeowners to understand the implications of this decision, including the potential tax consequences and the importance of obtaining legal advice. This process not only facilitates a smoother transition for the homeowner but also enables lenders to recover their investments more efficiently. Overall, the Deed in Lieu of Foreclosure can be a viable alternative for those looking to escape the burdens of foreclosure while maintaining a degree of control over their financial situation.

More State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It can provide an exit strategy for financially distressed homeowners looking to move on from their mortgage obligations.

Will I Owe Money After a Deed in Lieu of Foreclosure - This arrangement often leads to lesser fees than those incurred during foreclosure.

Completing the Virginia Homeschool Letter of Intent is a crucial step for parents embarking on their homeschooling journey, as it establishes their commitment to education outside conventional schools. To assist in this process, you can find a useful resource at homeschoolintent.com/editable-virginia-homeschool-letter-of-intent/, which provides additional guidance and editable templates to simplify the submission of this important document.

Foreclosure in Georgia - A Deed in Lieu could help you avoid the emotional distress of foreclosure.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can help both the borrower and the lender by allowing for a quicker resolution and minimizing losses associated with foreclosure proceedings.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically includes homeowners who are facing financial hardship and are unable to keep up with mortgage payments. Lenders often require that the homeowner has tried to sell the property and that the property is not worth more than the outstanding mortgage balance. Each lender may have specific criteria, so it’s essential to check with your lender for their requirements.

What are the benefits of a Deed in Lieu of Foreclosure?

One significant benefit is that it can help avoid the lengthy and stressful foreclosure process. Homeowners can also minimize damage to their credit scores compared to a foreclosure. Additionally, lenders may be more willing to negotiate terms, and homeowners may receive a release from the mortgage debt.

What are the potential downsides of a Deed in Lieu of Foreclosure?

While this option can be beneficial, there are potential downsides. Homeowners may still face tax implications on any forgiven debt. Additionally, not all lenders approve Deeds in Lieu, and homeowners may need to vacate the property quickly, which can be emotionally challenging.

How does the process work?

The process usually starts with the homeowner contacting the lender to express interest in a Deed in Lieu of Foreclosure. The lender will review the homeowner's financial situation and property details. If approved, the homeowner will sign the necessary documents, and ownership will transfer to the lender. The lender will then typically forgive the remaining mortgage balance.

Will I still owe money after the Deed in Lieu of Foreclosure?

In many cases, the lender will forgive the remaining mortgage debt as part of the agreement. However, this is not guaranteed. Homeowners should ensure they have a clear understanding of the terms before proceeding, as some lenders may pursue a deficiency judgment for any remaining balance.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure typically has a less severe impact on your credit score compared to a foreclosure. However, it can still negatively affect your score. The exact impact varies based on your overall credit history and the policies of credit reporting agencies.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can often negotiate the terms with their lender. This may include discussing the timeline for vacating the property or seeking a release from any remaining debt. It’s advisable to have all discussions documented and to seek legal advice if necessary.

What should I do before considering a Deed in Lieu of Foreclosure?

Before proceeding, homeowners should explore all options, such as loan modification or selling the property. Consulting with a housing counselor or attorney can provide valuable insights and help determine the best course of action based on individual circumstances.

Where can I find the Deed in Lieu of Foreclosure form?

The Deed in Lieu of Foreclosure form can often be obtained directly from your lender. Additionally, many online legal resources provide templates. However, it’s crucial to ensure that any form used complies with California state laws and meets the lender's requirements.

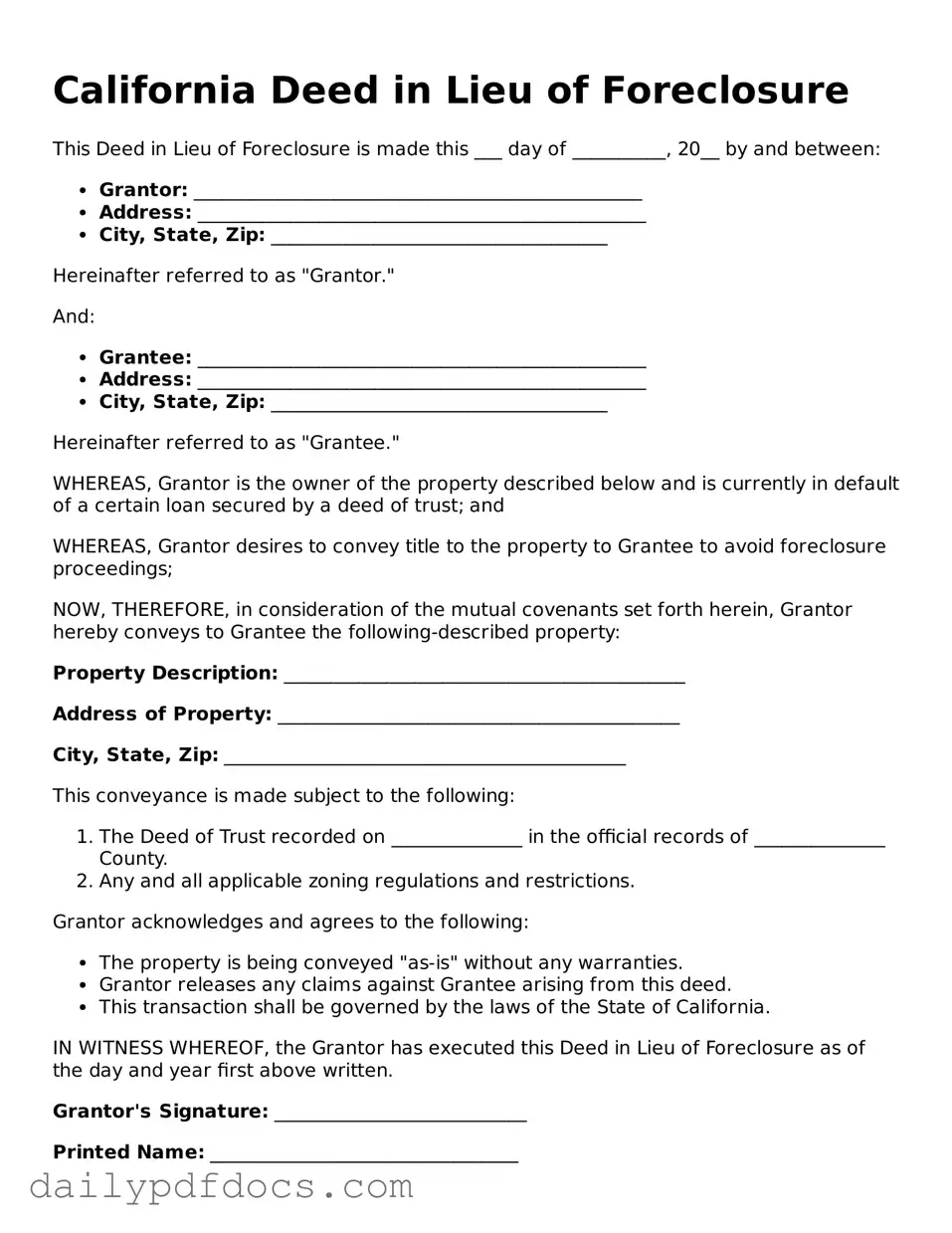

Preview - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20__ by and between:

- Grantor: ________________________________________________

- Address: ________________________________________________

- City, State, Zip: ____________________________________

Hereinafter referred to as "Grantor."

And:

- Grantee: ________________________________________________

- Address: ________________________________________________

- City, State, Zip: ____________________________________

Hereinafter referred to as "Grantee."

WHEREAS, Grantor is the owner of the property described below and is currently in default of a certain loan secured by a deed of trust; and

WHEREAS, Grantor desires to convey title to the property to Grantee to avoid foreclosure proceedings;

NOW, THEREFORE, in consideration of the mutual covenants set forth herein, Grantor hereby conveys to Grantee the following-described property:

Property Description: ___________________________________________

Address of Property: ___________________________________________

City, State, Zip: ___________________________________________

This conveyance is made subject to the following:

- The Deed of Trust recorded on ______________ in the official records of ______________ County.

- Any and all applicable zoning regulations and restrictions.

Grantor acknowledges and agrees to the following:

- The property is being conveyed "as-is" without any warranties.

- Grantor releases any claims against Grantee arising from this deed.

- This transaction shall be governed by the laws of the State of California.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor's Signature: ___________________________

Printed Name: _________________________________

Dated: ________________________________________

Witnessed by:

Witness Signature: ___________________________

Printed Name: _________________________________

Dated: ________________________________________

Similar forms

- Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a short sale allows a homeowner to sell their property for less than the amount owed on the mortgage. Both options aim to avoid foreclosure, but a short sale involves selling the home to a third party, while a deed in lieu transfers ownership directly to the lender.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in a property. Unlike a deed in lieu, it does not relieve the borrower of any debt, as it simply transfers ownership without warranty. For more information, visit legalformspdf.com.

- Loan Modification Agreement: This document alters the terms of the existing mortgage to make payments more manageable for the homeowner. While a deed in lieu relinquishes ownership, a loan modification seeks to keep the homeowner in their property by adjusting payment terms.

- Foreclosure Alternative Agreement: This is a broader term that encompasses various options, including a deed in lieu and short sales. It provides homeowners with alternatives to foreclosure, allowing them to negotiate terms that may be more favorable than losing their home.

- Forbearance Agreement: A forbearance agreement temporarily suspends mortgage payments, giving the homeowner time to recover financially. Unlike a deed in lieu, which involves giving up the property, forbearance allows homeowners to retain ownership while working towards a solution.

- Quitclaim Deed: This document transfers ownership of a property without guaranteeing that the title is clear. While a deed in lieu is a formal agreement with the lender, a quitclaim deed may not involve any financial institution and is often used between individuals.

- Deed of Trust: This document secures a loan by transferring property title to a trustee until the borrower repays the loan. Similar to a deed in lieu, it involves property transfer, but a deed of trust is primarily a security instrument rather than a resolution to foreclosure.

- Release of Mortgage: This document formally releases the lien on the property once the mortgage is paid off. In a deed in lieu, the mortgage is also effectively released, but the homeowner gives up the property instead of paying off the loan.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters. In some cases, it can be used to facilitate a deed in lieu by enabling an agent to sign documents on behalf of the homeowner, though it serves a different primary purpose.

- Settlement Agreement: This document resolves disputes between parties, often involving financial compensation. While a deed in lieu resolves the issue of an unpaid mortgage, a settlement agreement may address various legal disputes without transferring property ownership.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from debts, including mortgage obligations. While a deed in lieu is a voluntary process to avoid foreclosure, bankruptcy is a legal process that may involve the court and can lead to different outcomes for the homeowner.

Misconceptions

The California Deed in Lieu of Foreclosure form is often misunderstood. Here are eight common misconceptions about this process, along with clarifications to help you navigate the complexities of real estate transactions.

- It automatically cancels the mortgage debt. Many believe that signing a Deed in Lieu means the mortgage debt is erased. In reality, while it may relieve some debt, it does not always eliminate all financial obligations.

- It is a quick and easy solution. Some homeowners think that a Deed in Lieu is a simple, fast fix to avoid foreclosure. However, the process can involve negotiations and may take time to finalize.

- It is the same as a short sale. Many confuse a Deed in Lieu with a short sale. In a short sale, the lender agrees to accept less than the amount owed on the mortgage. In contrast, a Deed in Lieu involves transferring the property back to the lender without selling it first.

- All lenders accept Deeds in Lieu. Not every lender will agree to this arrangement. Each lender has its own policies, and some may prefer to pursue foreclosure instead.

- It has no impact on credit scores. Homeowners often assume that a Deed in Lieu will not affect their credit. While it may be less damaging than a foreclosure, it can still negatively impact credit scores.

- It is available to all homeowners. This option is not universally available. Eligibility often depends on specific circumstances, such as the lender's policies and the homeowner's financial situation.

- It releases all liabilities. Some believe that signing a Deed in Lieu releases them from all liabilities related to the property. However, if there are second mortgages or liens, those may still need to be addressed.

- It is a permanent solution to financial problems. A Deed in Lieu may alleviate immediate stress, but it does not address underlying financial issues. Homeowners should consider long-term financial planning even after this process.

Understanding these misconceptions can empower homeowners to make informed decisions about their financial futures. Always consult with a knowledgeable professional before proceeding with any real estate transaction.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document in which a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | California Civil Code Sections 2924-2924k govern the deed in lieu of foreclosure process in California. |

| Eligibility | Borrowers must typically demonstrate financial hardship and be unable to keep up with mortgage payments to qualify for this option. |

| Process | The borrower must submit a request to the lender, who will evaluate the situation and may require specific documentation. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process, potentially preserving their credit score. |

| Risks | Borrowers may still face tax implications, as the forgiven debt could be considered taxable income. |