Printable Bill of Sale Document for California

When engaging in the sale or transfer of personal property in California, a Bill of Sale form serves as a crucial document to ensure a smooth transaction. This form captures essential details about the sale, including the names and addresses of both the buyer and the seller, a clear description of the item being sold, and the purchase price. Additionally, it may include information about the condition of the item, any warranties provided, and the date of the transaction. By providing a written record, the Bill of Sale protects both parties by establishing proof of ownership and the terms of the sale. It is important to understand that while this form is not always legally required, having one can prevent disputes and provide clarity in case of future issues. Therefore, whether you are selling a vehicle, furniture, or any other personal property, utilizing a Bill of Sale is a prudent step to safeguard your interests and facilitate a transparent exchange.

More State-specific Bill of Sale Forms

Bill of Sale Car Texas - This form can empower individuals to engage in private sales confidently.

Blank Bill of Sale Form - This form can help establish a legal aid or provide a framework for resolving issues.

How to Sell a Car Privately in Florida - Can be used in sales between individuals or businesses.

Common Questions

What is a California Bill of Sale?

A California Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This document is commonly used for vehicles, boats, and other valuable items. It outlines the details of the transaction, including the buyer, seller, and item being sold.

Do I need a Bill of Sale for every transaction in California?

No, not every transaction requires a Bill of Sale. For example, if you are giving away an item without any exchange of money, a Bill of Sale is not necessary. However, it is a good idea to have one for significant transactions, especially for vehicles, to provide a record of the sale.

What information should be included in a California Bill of Sale?

A Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold (including any identifying numbers), the sale price, and the date of the transaction. It's also helpful to include any warranties or conditions of the sale.

Is a Bill of Sale required for vehicle sales in California?

Yes, a Bill of Sale is required for vehicle sales in California. It helps document the transfer of ownership and is often needed when registering the vehicle with the Department of Motor Vehicles (DMV). The DMV provides a specific form that can be used for this purpose.

Can I create my own Bill of Sale in California?

Yes, you can create your own Bill of Sale in California. It does not have to be a specific form, but it must include all the necessary information to be valid. Just make sure to keep it clear and comprehensive to avoid any misunderstandings later.

Does a Bill of Sale need to be notarized in California?

No, a Bill of Sale does not need to be notarized in California for it to be valid. However, having it notarized can provide an extra layer of protection and authenticity, especially for high-value transactions.

What if the item sold is damaged or not as described?

If the item sold is damaged or not as described, the buyer may have legal recourse depending on the terms outlined in the Bill of Sale. Including clear descriptions and any warranties in the document can help protect both parties in case of disputes.

Can a Bill of Sale be used as a receipt?

Yes, a Bill of Sale can serve as a receipt for the transaction. It provides proof that the buyer has paid for the item and that the seller has transferred ownership. Keeping a copy for your records is a good practice.

What happens if I lose my Bill of Sale?

If you lose your Bill of Sale, it may complicate things, especially if you need to prove ownership later. If possible, try to obtain a copy from the other party involved in the transaction. If that’s not possible, you may need to gather other evidence of the sale to establish ownership.

Where can I find a template for a California Bill of Sale?

You can find templates for a California Bill of Sale online through various legal websites or the DMV. These templates can help ensure you include all necessary information. Just make sure to customize it to fit your specific transaction.

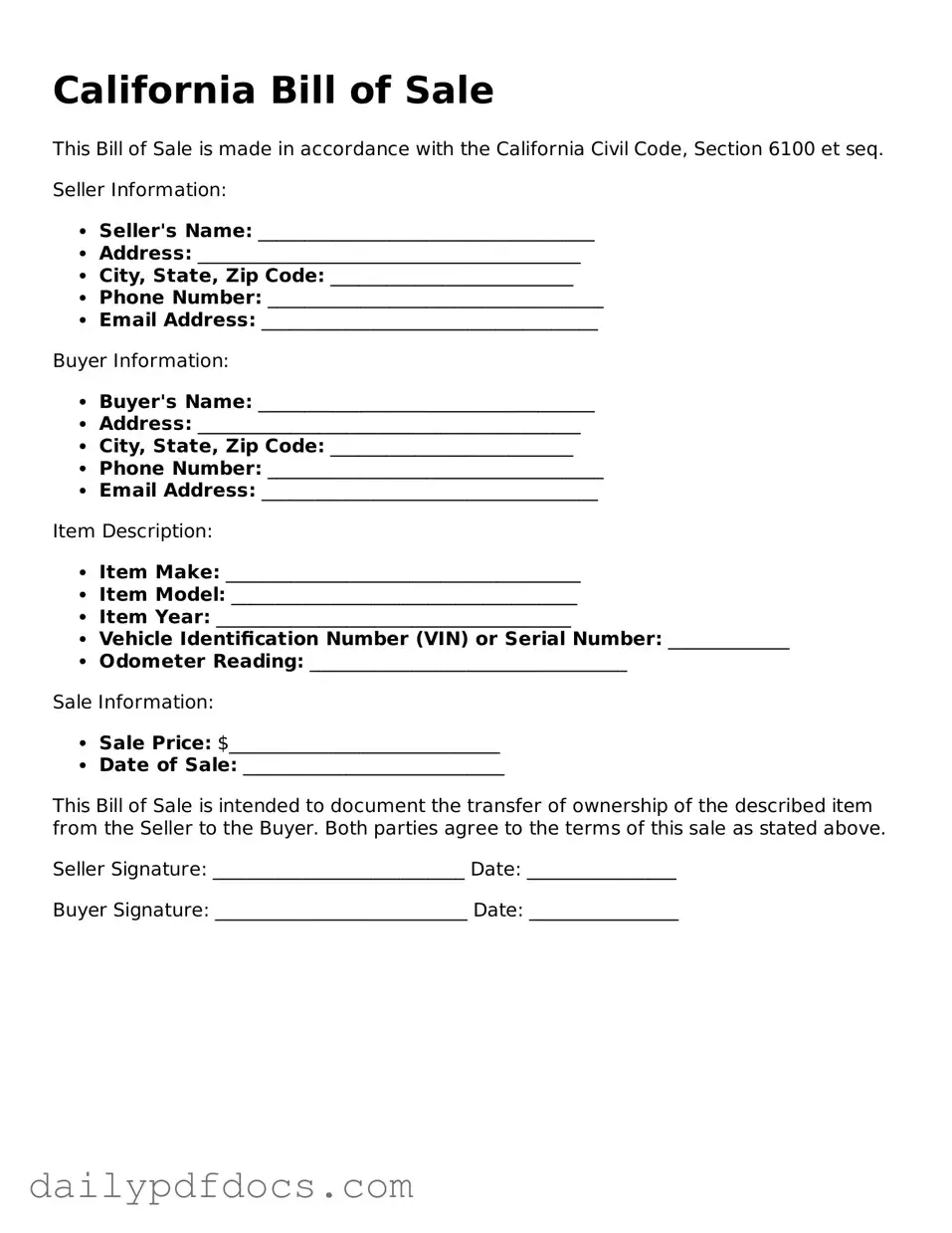

Preview - California Bill of Sale Form

California Bill of Sale

This Bill of Sale is made in accordance with the California Civil Code, Section 6100 et seq.

Seller Information:

- Seller's Name: ____________________________________

- Address: _________________________________________

- City, State, Zip Code: __________________________

- Phone Number: ____________________________________

- Email Address: ____________________________________

Buyer Information:

- Buyer's Name: ____________________________________

- Address: _________________________________________

- City, State, Zip Code: __________________________

- Phone Number: ____________________________________

- Email Address: ____________________________________

Item Description:

- Item Make: ______________________________________

- Item Model: _____________________________________

- Item Year: ______________________________________

- Vehicle Identification Number (VIN) or Serial Number: _____________

- Odometer Reading: __________________________________

Sale Information:

- Sale Price: $_____________________________

- Date of Sale: ____________________________

This Bill of Sale is intended to document the transfer of ownership of the described item from the Seller to the Buyer. Both parties agree to the terms of this sale as stated above.

Seller Signature: ___________________________ Date: ________________

Buyer Signature: ___________________________ Date: ________________

Similar forms

A Bill of Sale is a document that serves as proof of the transfer of ownership of an item, typically personal property. Several other documents share similar functions, providing evidence of transactions or ownership changes. Here are eight documents that are comparable to a Bill of Sale:

- Receipt: A receipt confirms that a payment has been made for goods or services. Like a Bill of Sale, it provides evidence of a transaction but is usually less detailed regarding ownership transfer.

- Title: A title is a legal document that establishes ownership of a vehicle or property. It is similar to a Bill of Sale in that it signifies ownership, but it is often required for registering the item with governmental authorities.

- Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While it does not transfer ownership, it does provide a record of the arrangement between the parties, similar to how a Bill of Sale documents a sale.

- ADP Pay Stub: This document is essential for employees as it details earnings and deductions for a specific pay period, helping individuals track their income effectively. For more information, visit Document Templates Hub.

- Warranty Deed: A warranty deed is used in real estate transactions to guarantee that the seller has the right to transfer ownership. Like a Bill of Sale, it serves as a formal record of the transfer of property rights.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money to a designated person at a certain time. It is similar in that it documents a financial transaction, though it focuses on the obligation to pay rather than the transfer of ownership.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf in legal matters. While not a sale document, it can facilitate transactions that may require a Bill of Sale by allowing one party to sign on behalf of another.

- Gift Deed: A gift deed transfers property ownership without a sale. It is similar to a Bill of Sale in that it documents a change in ownership, but it does not involve a financial transaction.

- Sales Agreement: A sales agreement outlines the terms of a sale between a buyer and a seller. Like a Bill of Sale, it provides a detailed account of the transaction, including what is being sold and the agreed-upon price.

Misconceptions

The California Bill of Sale form is a useful document for recording the sale of personal property. However, several misconceptions surround its use. Here are six common misunderstandings:

- It is only for vehicles. Many people believe that a Bill of Sale is only necessary for vehicles. In reality, it can be used for various personal property transactions, including furniture, electronics, and more.

- It is not legally binding. Some think that a Bill of Sale holds no legal weight. However, when properly completed and signed, it serves as a legal record of the transaction and can be used in court if disputes arise.

- It is not required in California. While a Bill of Sale is not always legally required, it is highly recommended for protecting both the buyer and seller. It provides proof of ownership transfer and can help avoid future complications.

- Only the seller needs to sign it. A common belief is that only the seller's signature is necessary. In fact, both the buyer and seller should sign the document to validate the transaction.

- It must be notarized. Some people think a Bill of Sale must be notarized to be valid. Notarization is not required in California, but it can add an extra layer of security to the document.

- It is a complicated document. Many assume that creating a Bill of Sale is difficult. In truth, it is a straightforward document that typically requires basic information about the buyer, seller, and the item being sold.

Understanding these misconceptions can help ensure that individuals use the California Bill of Sale effectively and protect their interests in transactions.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The California Bill of Sale form serves as a legal document to transfer ownership of personal property from one party to another. |

| Governing Law | This form is governed by California Civil Code Sections 1721 and 1738, which outline the requirements for sales transactions. |

| Types of Property | It can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not mandatory for all transactions, it is recommended for added legal protection. |

| Information Required | The form typically requires details about the buyer, seller, and the item being sold, including a description and sale price. |

| Record Keeping | Both parties should keep a copy of the completed Bill of Sale for their records, as it can serve as proof of the transaction. |