Printable Articles of Incorporation Document for California

The California Articles of Incorporation form is a critical document for anyone looking to establish a corporation in the state. This form serves as the official declaration of the corporation's existence and outlines essential information about the business. Key aspects include the corporation's name, which must be unique and not easily confused with existing entities. Additionally, the form requires the designation of a registered agent, who will receive legal documents on behalf of the corporation. It also specifies the corporation's purpose, which can be broad or specific, depending on the business goals. Furthermore, the Articles of Incorporation include details about the stock structure, such as the number of shares and their classes, if applicable. Finally, the form must be signed by the incorporators, who are responsible for submitting it to the California Secretary of State. Properly completing and filing this form is essential for legal compliance and helps lay the groundwork for a successful business venture in California.

More State-specific Articles of Incorporation Forms

Georgia Secretary of State Forms - The form is crucial for limiting personal liability of the owners.

Where Can I Find Articles of Incorporation - The Articles can address future amendments to the corporate structure.

Common Questions

What are the California Articles of Incorporation?

The California Articles of Incorporation is a legal document that establishes a corporation in the state of California. It outlines essential information about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. This document must be filed with the California Secretary of State to officially create the corporation.

Who needs to file Articles of Incorporation?

Any individual or group looking to form a corporation in California must file Articles of Incorporation. This includes businesses intending to operate for profit, as well as non-profit organizations. It is important to ensure that the corporation complies with state laws and regulations.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the corporation's name, the address of its principal office, the name and address of the initial agent for service of process, the purpose of the corporation, and the number of shares the corporation is authorized to issue. Additional provisions can also be included if desired.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the form online, by mail, or in person at the Secretary of State's office. If filing by mail, be sure to include the appropriate filing fee. Online submissions often provide a faster processing time.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in California varies depending on the type of corporation being formed. As of October 2023, the standard fee for a general corporation is $100. Non-profit corporations may have different fees. Always check the California Secretary of State's website for the most current fee schedule.

How long does it take for the Articles of Incorporation to be processed?

Processing times for the Articles of Incorporation can vary. Typically, if filed online, it may take a few business days. Mail submissions can take longer, sometimes up to several weeks. Expedited services are available for an additional fee if faster processing is needed.

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation is officially formed. You will receive a stamped copy of the Articles from the Secretary of State. After this, it is essential to comply with other legal requirements, such as obtaining an Employer Identification Number (EIN) and creating corporate bylaws.

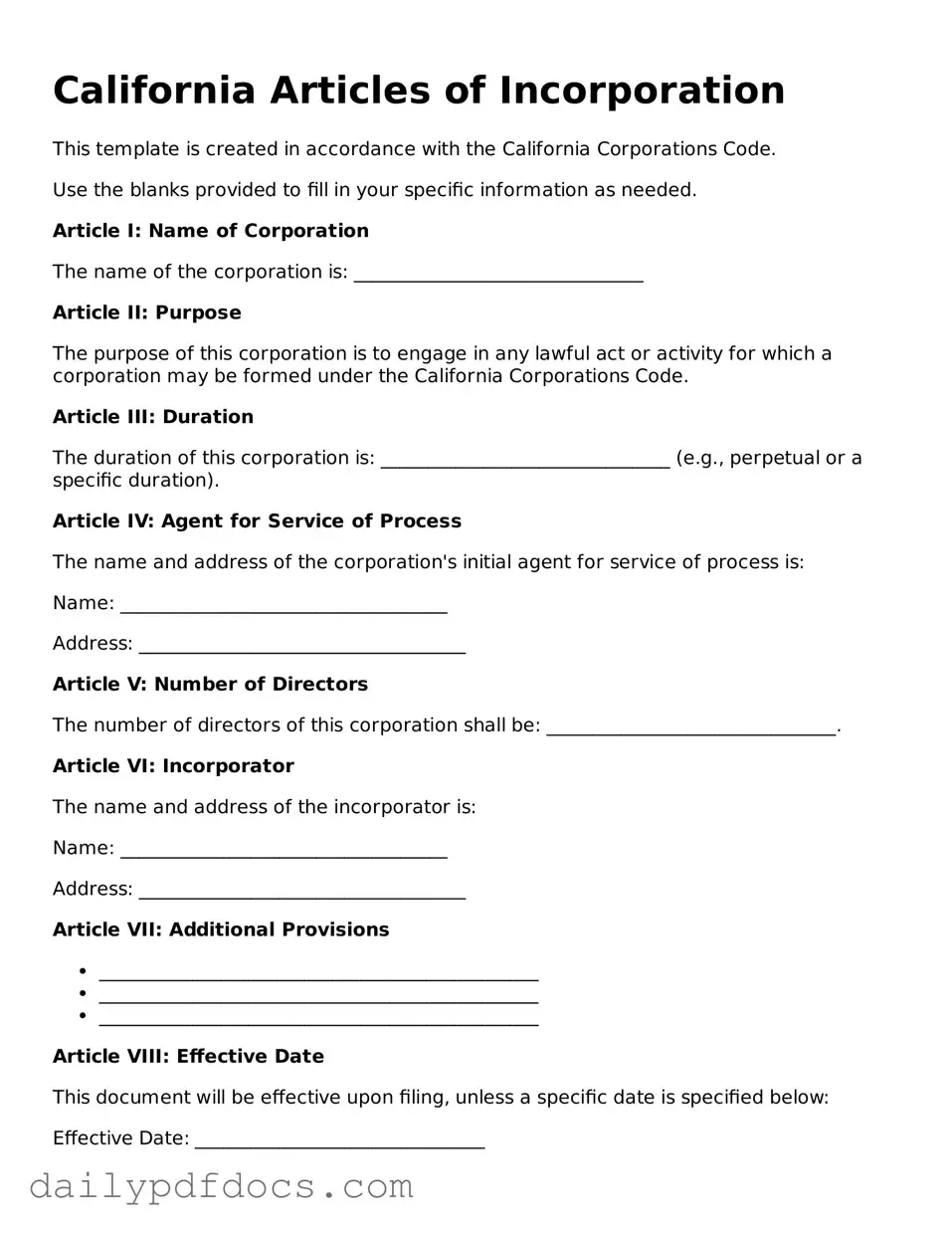

Preview - California Articles of Incorporation Form

California Articles of Incorporation

This template is created in accordance with the California Corporations Code.

Use the blanks provided to fill in your specific information as needed.

Article I: Name of Corporation

The name of the corporation is: _______________________________

Article II: Purpose

The purpose of this corporation is to engage in any lawful act or activity for which a corporation may be formed under the California Corporations Code.

Article III: Duration

The duration of this corporation is: _______________________________ (e.g., perpetual or a specific duration).

Article IV: Agent for Service of Process

The name and address of the corporation's initial agent for service of process is:

Name: ___________________________________

Address: ___________________________________

Article V: Number of Directors

The number of directors of this corporation shall be: _______________________________.

Article VI: Incorporator

The name and address of the incorporator is:

Name: ___________________________________

Address: ___________________________________

Article VII: Additional Provisions

- _______________________________________________

- _______________________________________________

- _______________________________________________

Article VIII: Effective Date

This document will be effective upon filing, unless a specific date is specified below:

Effective Date: _______________________________

IN WITNESS WHEREOF, the incorporator has executed these Articles of Incorporation on this ____ day of __________, 20__.

Signature of Incorporator: ___________________________________

Similar forms

The Articles of Incorporation is a crucial document for establishing a corporation. It serves as the foundation for the legal existence of the company. Several other documents share similarities with the Articles of Incorporation in terms of purpose and function. Here are seven such documents:

- Bylaws: Bylaws outline the internal rules and regulations governing the corporation. While the Articles of Incorporation establish the corporation's existence, the bylaws detail how it will operate, including management structure and procedures for meetings.

- Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves the same purpose of formally establishing a corporation with the state and includes similar information about the business.

-

Lease Agreement: A California Lease Agreement form is a legally binding document that outlines the terms and conditions of renting a residential or commercial property in California. This form serves as a critical tool for both landlords and tenants, ensuring clear communication and understanding of their rights and responsibilities. To get started on your lease agreement today, fill out the form by clicking the button below. For more resources, visit Top Document Templates.

- Operating Agreement: Primarily used by limited liability companies (LLCs), this document sets forth the management structure and operational guidelines. Like the Articles of Incorporation, it is essential for defining how the entity will function.

- Partnership Agreement: This document is created when two or more individuals decide to form a partnership. It outlines the roles, responsibilities, and profit-sharing arrangements, similar to how the Articles define the corporation's structure and purpose.

- Business License: A business license is required to legally operate a business within a certain jurisdiction. While it does not establish the business entity, it is necessary for compliance and is often obtained after the Articles of Incorporation are filed.

- Employer Identification Number (EIN): An EIN is a federal tax identification number for businesses. It is essential for tax purposes and is often obtained after the Articles of Incorporation, serving as a unique identifier for the corporation.

- Annual Report: Corporations are often required to file annual reports with the state to maintain good standing. This document provides updated information about the corporation, similar to how the Articles of Incorporation initially disclose key details about the business.

Misconceptions

When it comes to the California Articles of Incorporation form, there are several misconceptions that can lead to confusion. Understanding these misconceptions is crucial for anyone looking to establish a corporation in California. Here are five common misunderstandings:

- Only large businesses need to file Articles of Incorporation. Many people believe that incorporating is only necessary for large companies. In reality, any business owner planning to operate as a corporation, regardless of size, should file this document to protect personal assets and gain credibility.

- Filing Articles of Incorporation guarantees business success. While incorporation can provide legal protections and benefits, it does not ensure that a business will be successful. Success depends on various factors, including market demand, management skills, and effective marketing strategies.

- Once filed, Articles of Incorporation cannot be changed. Some individuals think that the information submitted is permanent. However, amendments can be made to the Articles of Incorporation if changes are necessary, such as altering the business name or adjusting the number of shares authorized.

- All businesses must incorporate in California. There is a misconception that every business operating in California must file Articles of Incorporation in the state. In truth, businesses can choose to incorporate in other states, provided they follow the necessary regulations for doing business in California.

- The Articles of Incorporation are the only legal requirement for starting a corporation. Many assume that filing this document is the sole step needed to establish a corporation. In fact, additional steps are required, such as obtaining necessary permits, licenses, and adhering to ongoing compliance obligations.

By clarifying these misconceptions, individuals can make informed decisions about incorporating their businesses in California. Understanding the process and its implications is key to laying a strong foundation for future success.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to officially create a corporation in California. |

| Governing Law | This form is governed by the California Corporations Code, specifically sections 200-215. |

| Filing Requirements | To file the Articles of Incorporation, a minimum of one incorporator is required, and they can be an individual or a business entity. |

| Information Needed | The form requires basic information, including the corporation's name, address, and the purpose of the business. |

| Filing Fee | A filing fee must be paid when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | Typically, the processing time for the Articles of Incorporation can range from a few days to several weeks, depending on the volume of submissions. |

| Amendments | If changes are needed after filing, amendments to the Articles of Incorporation can be made by filing a separate form with the state. |