Free Business Purchase and Sale Agreement Template

When contemplating the acquisition or sale of a business, a Business Purchase and Sale Agreement serves as a critical document that outlines the terms and conditions of the transaction. This form encapsulates essential elements such as the purchase price, payment terms, and the timeline for the transfer of ownership. It also addresses the assets being sold, which may include inventory, equipment, intellectual property, and goodwill. Additionally, the agreement often includes representations and warranties from both the buyer and seller, ensuring that both parties are transparent about the business's condition and operations. Other key aspects may involve contingencies that must be met before the sale can be finalized, as well as provisions for non-compete clauses that protect the buyer’s interests post-sale. By clearly detailing these components, the Business Purchase and Sale Agreement not only facilitates a smoother transaction process but also helps to mitigate potential disputes that may arise in the future.

Find Common Templates

Artwork Release Form Pdf - This form can be an artist’s shield against unauthorized use of their work.

To further clarify the process of transferring ownership, it is recommended that both parties utilize the Ohio Mobile Home Bill of Sale template available at mobilehomebillofsale.com/blank-ohio-mobile-home-bill-of-sale, which can help ensure that all necessary details are accurately captured during the transaction.

6 Team Single Elimination Bracket With Consolation - Friendships strengthen as teams compete in the bracket.

Common Questions

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions of a transaction where one party buys a business from another. This agreement typically includes details such as the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial because it protects both the buyer and the seller by clearly defining the expectations and responsibilities of each party. It helps to prevent misunderstandings and disputes by providing a written record of the transaction details.

What key elements should be included in the agreement?

Essential elements of a Business Purchase and Sale Agreement include the names of the parties involved, a detailed description of the business being sold, the purchase price, payment structure, representations and warranties, and any conditions that must be satisfied before closing the sale.

Who typically prepares the Business Purchase and Sale Agreement?

While a lawyer often drafts the agreement to ensure it meets legal standards, buyers and sellers can also collaborate to create a preliminary version. It is advisable to have a legal professional review the document before signing to ensure that all necessary legal protections are in place.

What happens if the terms of the agreement are not met?

If either party fails to meet the terms outlined in the agreement, it can lead to a breach of contract. The non-breaching party may have the right to seek remedies, which could include monetary damages or specific performance, depending on the situation and the terms of the agreement.

Can the agreement be modified after it is signed?

Yes, the Business Purchase and Sale Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both parties to ensure clarity and enforceability.

Is a Business Purchase and Sale Agreement necessary for every business transaction?

While it is not legally required for every transaction, having a Business Purchase and Sale Agreement is highly recommended. It provides a structured approach to the sale and helps protect both parties, especially in larger or more complex transactions.

What is the role of contingencies in the agreement?

Contingencies are conditions that must be met for the sale to proceed. They can include financing approval, satisfactory due diligence results, or obtaining necessary permits. Including contingencies helps to mitigate risks for the buyer and ensures that the sale is contingent on specific outcomes.

How can I ensure that the agreement is enforceable?

To ensure enforceability, the agreement should be clear, comprehensive, and signed by both parties. It is also advisable to have the document reviewed by a legal professional to confirm that it complies with applicable laws and adequately protects the interests of both parties.

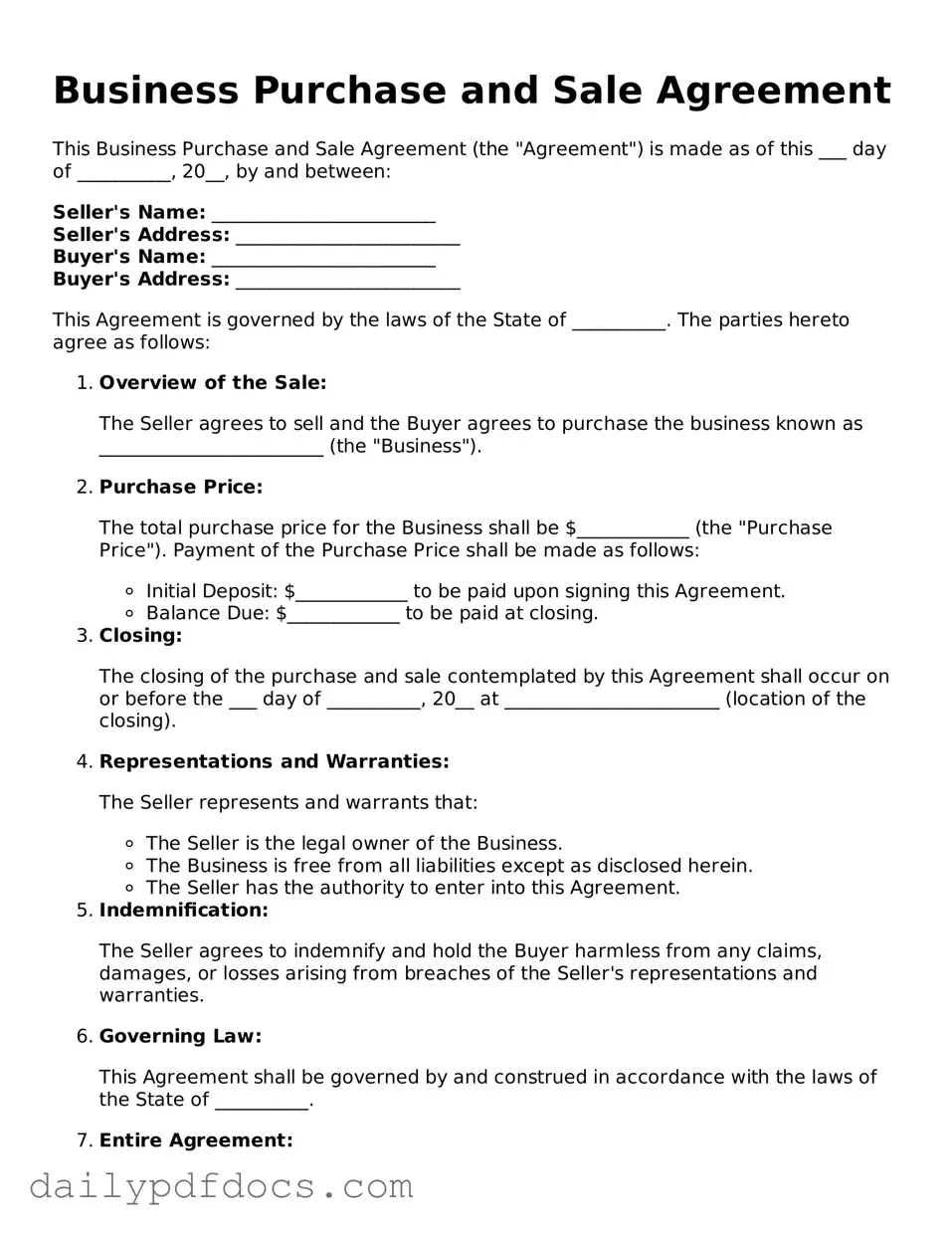

Preview - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (the "Agreement") is made as of this ___ day of __________, 20__, by and between:

Seller's Name: ________________________

Seller's Address: ________________________

Buyer's Name: ________________________

Buyer's Address: ________________________

This Agreement is governed by the laws of the State of __________. The parties hereto agree as follows:

-

Overview of the Sale:

The Seller agrees to sell and the Buyer agrees to purchase the business known as ________________________ (the "Business").

-

Purchase Price:

The total purchase price for the Business shall be $____________ (the "Purchase Price"). Payment of the Purchase Price shall be made as follows:

- Initial Deposit: $____________ to be paid upon signing this Agreement.

- Balance Due: $____________ to be paid at closing.

-

Closing:

The closing of the purchase and sale contemplated by this Agreement shall occur on or before the ___ day of __________, 20__ at _______________________ (location of the closing).

-

Representations and Warranties:

The Seller represents and warrants that:

- The Seller is the legal owner of the Business.

- The Business is free from all liabilities except as disclosed herein.

- The Seller has the authority to enter into this Agreement.

-

Indemnification:

The Seller agrees to indemnify and hold the Buyer harmless from any claims, damages, or losses arising from breaches of the Seller's representations and warranties.

-

Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

-

Entire Agreement:

This Agreement constitutes the entire understanding between the parties. No modifications to this Agreement shall be valid unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

Seller's Signature: ___________________________

Buyer's Signature: ___________________________

Date: ___________________________

Similar forms

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before the final agreement. Like the Business Purchase and Sale Agreement, it sets the stage for negotiations and indicates the intent to move forward with the transaction.

- Investment Letter of Intent: For those looking to establish a preliminary commitment in investments, our essential Investment Letter of Intent form requirements outline the foundational steps necessary for effective negotiations.

- Asset Purchase Agreement: Similar to the Business Purchase and Sale Agreement, this document specifically details the purchase of individual assets of a business rather than the business as a whole. It includes terms regarding the assets being acquired, liabilities, and the purchase price.

- Stock Purchase Agreement: This agreement focuses on the purchase of shares in a corporation. Like the Business Purchase and Sale Agreement, it outlines the terms of the sale, including the number of shares, purchase price, and representations made by both parties.

- Confidentiality Agreement (NDA): This document ensures that sensitive information exchanged during the negotiation process remains protected. It complements the Business Purchase and Sale Agreement by safeguarding proprietary information that could influence the sale.

- Due Diligence Checklist: While not a formal contract, this checklist guides the buyer through the process of investigating the business being purchased. It shares a common goal with the Business Purchase and Sale Agreement: ensuring that the buyer is fully informed before finalizing the transaction.

- Closing Statement: This document summarizes the final terms of the sale at the closing of the transaction. It is similar to the Business Purchase and Sale Agreement in that it provides a detailed account of the financial aspects of the deal, ensuring both parties understand their obligations.

Misconceptions

Business Purchase and Sale Agreements are crucial documents in the process of transferring ownership of a business. However, several misconceptions about these agreements can lead to confusion and potential legal issues. Below is a list of common misconceptions and clarifications regarding the Business Purchase and Sale Agreement.

- All agreements are the same. Many people believe that all Business Purchase and Sale Agreements are interchangeable. In reality, these agreements should be tailored to reflect the specific terms and conditions of the transaction.

- Verbal agreements are sufficient. Some individuals think that a verbal agreement is enough to finalize a business sale. However, without a written contract, parties may face difficulties in enforcing their rights and obligations.

- Only lawyers can draft these agreements. While it is advisable to have legal counsel, business owners can draft the agreement themselves. However, professional guidance can help ensure that all legal requirements are met.

- All terms are negotiable. Some believe that every aspect of the agreement can be negotiated. While many terms are negotiable, certain legal and regulatory requirements may limit flexibility.

- The agreement only covers price. Many assume that the purchase price is the only important aspect of the agreement. In fact, it also addresses liabilities, warranties, and other critical details that affect the transaction.

- Once signed, the agreement cannot be changed. There is a misconception that signed agreements are set in stone. In truth, parties can amend the agreement if both sides consent to the changes.

- Due diligence is unnecessary. Some individuals believe that due diligence is an optional step. However, thorough investigation of the business’s financial and legal standing is essential to avoid future liabilities.

- The agreement is only for the seller's protection. It is a common belief that the Business Purchase and Sale Agreement primarily benefits the seller. In reality, it serves to protect both parties by clearly outlining their rights and responsibilities.

- Signing the agreement means the sale is complete. Many think that signing the agreement finalizes the sale. However, the transaction may still be contingent upon other factors, such as financing or regulatory approvals.

Understanding these misconceptions can help individuals navigate the complexities of business transactions more effectively. A well-crafted Business Purchase and Sale Agreement is essential for ensuring a smooth transfer of ownership.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Business Purchase and Sale Agreement outlines the terms and conditions under which a business is sold. It serves to protect both the buyer and seller by clearly stating the rights and obligations of each party. |

| Key Components | This agreement typically includes details such as the purchase price, payment terms, representations and warranties, and conditions for closing the sale. Each component plays a vital role in ensuring a smooth transaction. |

| Governing Law | The governing law may vary by state. For instance, in California, the agreement is governed by California Commercial Code, while in New York, it falls under the New York Uniform Commercial Code. |

| Importance of Legal Review | It is crucial for both parties to seek legal advice before signing the agreement. A thorough review can help identify potential issues and ensure that the agreement aligns with both parties' interests. |