Fill Your Business Credit Application Form

When seeking credit for a business, completing a Business Credit Application form is a crucial step that can significantly impact your financial journey. This form serves as a comprehensive tool for lenders to evaluate the creditworthiness of a business. It typically includes essential information such as the business name, address, and contact details, as well as the legal structure of the business—whether it's a sole proprietorship, partnership, or corporation. Financial history is another key aspect, where applicants are often required to provide details about annual revenue, existing debts, and credit references. Additionally, personal information about the owners or major stakeholders may be requested to assess individual credit histories. By thoroughly understanding and accurately filling out this form, business owners can enhance their chances of securing the necessary funding to grow and sustain their operations.

Find Other Documents

Form 1098 - Look for important messages regarding partial payments and their implications.

When engaging in a motorcycle transaction, it's important to have all necessary documentation in order. The Washington Motorcycle Bill of Sale form is a crucial document that facilitates the sale and transfer of ownership in Washington State. This form ensures that all parties involved have a clear understanding of the details of the motorcycle sale, including buyer and seller information. For a reliable resource to obtain this form, you can visit Washington Templates.

Marriage Certificate California - Strengthens legal bonds between married individuals in various contexts.

Common Questions

What is the purpose of the Business Credit Application form?

The Business Credit Application form is designed to gather essential information about a business seeking credit. This information helps lenders assess the creditworthiness of the business and determine the terms of credit that can be extended. It typically includes details such as business structure, ownership, financial history, and references.

Who should fill out the Business Credit Application form?

The form should be completed by an authorized representative of the business, such as an owner, partner, or corporate officer. This ensures that the information provided is accurate and that the person submitting the application has the authority to do so on behalf of the business.

What information is required on the Business Credit Application form?

Commonly required information includes the business name, address, type of business entity, tax identification number, and contact information. Additionally, financial statements, bank references, and trade references may also be requested to provide a complete picture of the business's financial health.

How long does it take to process the Business Credit Application?

The processing time can vary depending on the lender and the complexity of the application. Typically, it can take anywhere from a few days to a couple of weeks. Factors such as the completeness of the application and the responsiveness of references can impact the timeline.

What happens after the Business Credit Application is submitted?

Once submitted, the lender will review the application and may reach out for additional information or clarification. After the review process, the lender will make a decision regarding the credit request. If approved, the business will receive terms and conditions for the credit offered. If denied, the lender may provide reasons for the decision.

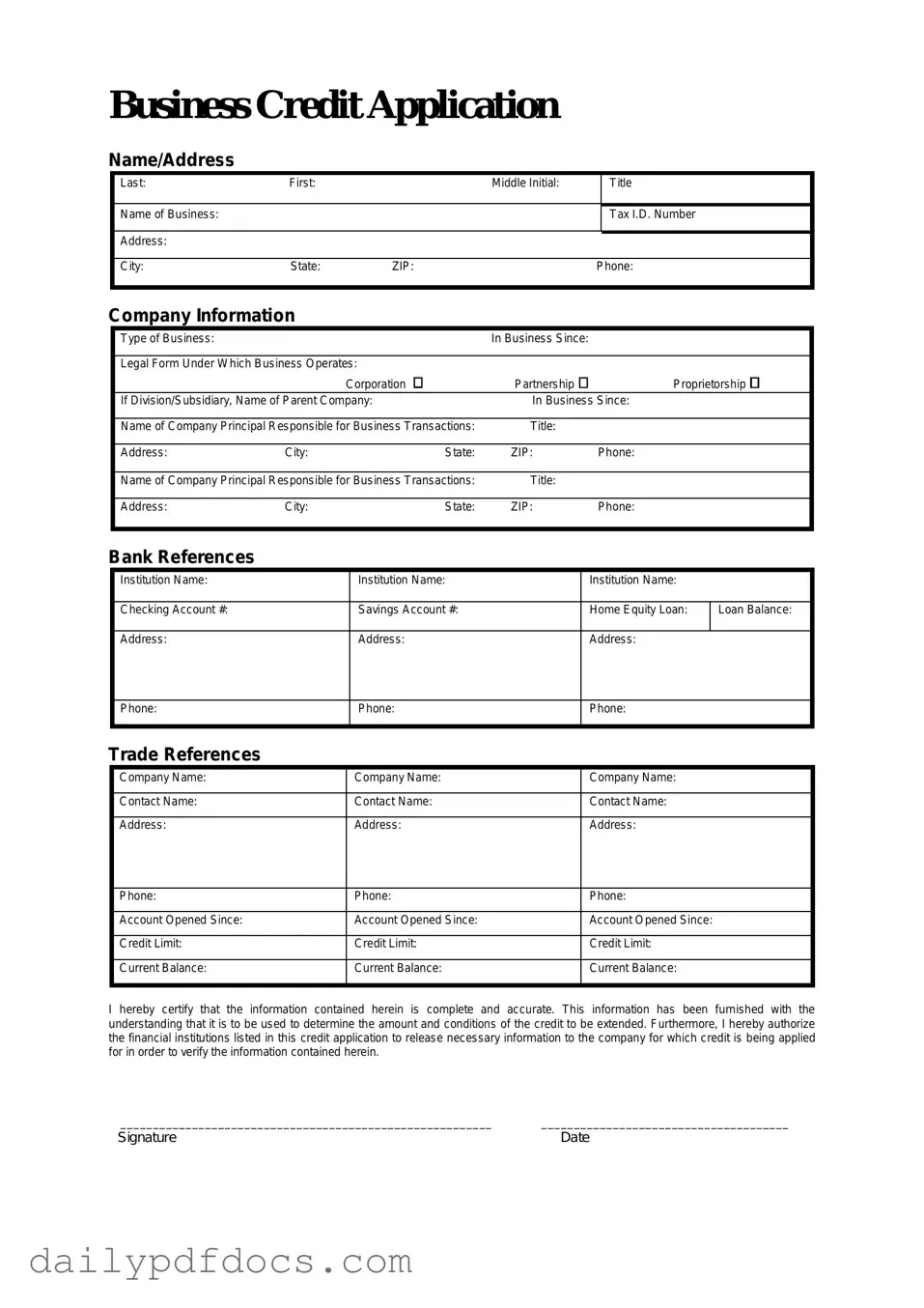

Preview - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Similar forms

-

Loan Application Form: This document serves a similar purpose by collecting essential information about a business seeking financing. Both forms require details about the business's financial health and operational history to assess creditworthiness.

-

Vendor Credit Application: Like the Business Credit Application, this document is used by suppliers to evaluate a business's credit risk before extending credit. It typically includes similar financial disclosures and references.

-

Lease Application: When a business applies for a lease, this form gathers information about the applicant's financial stability and history. It parallels the Business Credit Application in its goal of assessing risk for the lessor.

-

Business Loan Agreement: Although this is a contractual document rather than an application, it often references information collected in the credit application process. Both documents aim to establish the terms of credit and the responsibilities of the borrower.

-

Partnership Agreement: This document outlines the terms of a business partnership and may require similar financial disclosures to assess the viability of the partnership. Both forms emphasize the importance of financial transparency.

-

Business Registration Form: While primarily for legal recognition, this form collects essential business information, much like a credit application. Both documents require details about the business structure and ownership.

-

Personal Guarantee Form: This document often accompanies a credit application, especially for small businesses. It requires personal financial information from owners, similar to how a business credit application assesses risk.

-

Financial Statement: This document provides a snapshot of a business's financial health. It is often required alongside a credit application to support the information provided and validate the business's creditworthiness.

Misconceptions

Many individuals and businesses have misunderstandings about the Business Credit Application form. Below are five common misconceptions, along with clarifications to help you better understand the process.

-

Misconception 1: The form is only for large businesses.

This is not true. The Business Credit Application is available for businesses of all sizes. Small businesses can benefit from credit options just as much as larger enterprises.

-

Misconception 2: Filling out the form guarantees approval.

Submitting the application does not ensure that credit will be granted. Approval depends on various factors, including credit history and financial stability.

-

Misconception 3: Personal credit does not affect business credit applications.

In many cases, lenders will consider personal credit history when evaluating a business application, especially for new businesses without an established credit profile.

-

Misconception 4: The application is too complicated to complete.

While it may seem daunting, the Business Credit Application is designed to be straightforward. Most sections require basic information about your business and financials.

-

Misconception 5: There are no fees associated with the application.

Some lenders may charge fees for processing the application or for setting up a credit account. It is important to read all terms and conditions before submitting.

Understanding these misconceptions can help you navigate the Business Credit Application process more effectively. Being informed will empower you to make better financial decisions for your business.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | This form typically requires details such as business name, address, ownership structure, and financial information. |

| Importance of Accuracy | Accurate information is crucial, as it helps lenders assess creditworthiness and make informed decisions. |

| State-Specific Variations | Some states may have specific requirements or variations in the form. For example, California law may require additional disclosures under the California Consumer Privacy Act. |

| Legal Implications | Submitting a Business Credit Application may create a binding agreement if approved, so understanding the terms is essential. |