Free Business Bill of Sale Template

When engaging in the sale of a business, having a clear and comprehensive Business Bill of Sale form is essential for both buyers and sellers. This document serves as a formal record of the transaction, detailing the terms and conditions agreed upon by both parties. It typically includes crucial information such as the names and addresses of the buyer and seller, a description of the business being sold, and the purchase price. Additionally, it may outline any included assets, such as equipment, inventory, or intellectual property, ensuring that all parties understand what is being transferred. By using this form, both the buyer and seller can protect their interests, clarify ownership rights, and establish a legally binding agreement that can help prevent future disputes. A well-prepared Business Bill of Sale not only facilitates a smooth transaction but also provides peace of mind for everyone involved.

Popular Business Bill of Sale Templates:

Equipment Bill of Sale - Having a written Bill of Sale can enhance the resale value of the equipment.

For those looking to create a legally binding transfer of ownership, a useful resource is Colorado PDF Templates, which provides templates and guidance for completing a Colorado Bill of Sale. This document is essential for ensuring that both parties are clear on the sale details, facilitating a smooth transaction.

Do Golf Carts Have a Title - Document the sale price and condition of the golf cart sold.

Where to Sell Limited Edition Prints - Commonly used in private and commercial art sales.

Common Questions

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that serves as proof of the transfer of ownership of a business or its assets from one party to another. This document outlines the details of the transaction, including the names of the buyer and seller, a description of the business or assets being sold, and the sale price. It is essential for both parties to have a record of the transaction for legal and tax purposes.

Why is a Business Bill of Sale important?

This document is crucial because it provides legal protection for both the buyer and the seller. For the seller, it confirms that they have received payment and have transferred ownership. For the buyer, it serves as evidence of ownership and can be used to establish rights to the business or assets. Additionally, it may be required by financial institutions or government agencies when seeking loans or permits.

What information should be included in a Business Bill of Sale?

Essential information in a Business Bill of Sale includes the names and addresses of both the buyer and seller, a detailed description of the business or assets being sold, the sale price, the date of the transaction, and any terms or conditions related to the sale. It may also include warranties or representations made by the seller regarding the condition of the business or assets.

Is a Business Bill of Sale required by law?

While a Business Bill of Sale is not always legally required, it is highly recommended. Many states do not mandate a bill of sale for the transfer of business ownership, but having one can help prevent disputes and provide clarity regarding the transaction. Additionally, certain types of assets, such as vehicles or real estate, may require a bill of sale for legal transfer.

How can I create a Business Bill of Sale?

Creating a Business Bill of Sale can be straightforward. Templates are widely available online, or one can draft a custom document. It is advisable to include all relevant details and to ensure that both parties sign the document. Consulting with a legal professional can also provide guidance to ensure that the bill of sale meets all necessary legal requirements.

What happens if I do not have a Business Bill of Sale?

Without a Business Bill of Sale, both the buyer and seller may face challenges in proving ownership or the terms of the sale. This lack of documentation can lead to disputes, misunderstandings, or complications when seeking financing or permits. Therefore, it is wise to have a bill of sale to safeguard both parties' interests.

Can a Business Bill of Sale be modified after it is signed?

Once a Business Bill of Sale is signed, it generally becomes a binding agreement. However, modifications can be made if both parties agree to the changes. It is best practice to document any modifications in writing and to have both parties sign the amended document to avoid future disputes.

Do I need a notary for a Business Bill of Sale?

While notarization is not always required, having a Business Bill of Sale notarized can add an extra layer of authenticity and protection. A notary public verifies the identities of the parties involved and witnesses the signing of the document, which can be beneficial in case of future disputes.

What should I do with the Business Bill of Sale after it is signed?

After signing, both the buyer and seller should retain copies of the Business Bill of Sale for their records. It is important to store these documents in a safe place, as they may be needed for tax purposes, legal matters, or future transactions. Keeping both digital and physical copies can help ensure that the document is easily accessible when needed.

Can a Business Bill of Sale be used for partial ownership transfers?

Yes, a Business Bill of Sale can be used for partial ownership transfers. In such cases, the document should clearly specify the percentage of ownership being transferred and any relevant terms regarding the ongoing rights and responsibilities of each party. Clarity in these details helps prevent misunderstandings in the future.

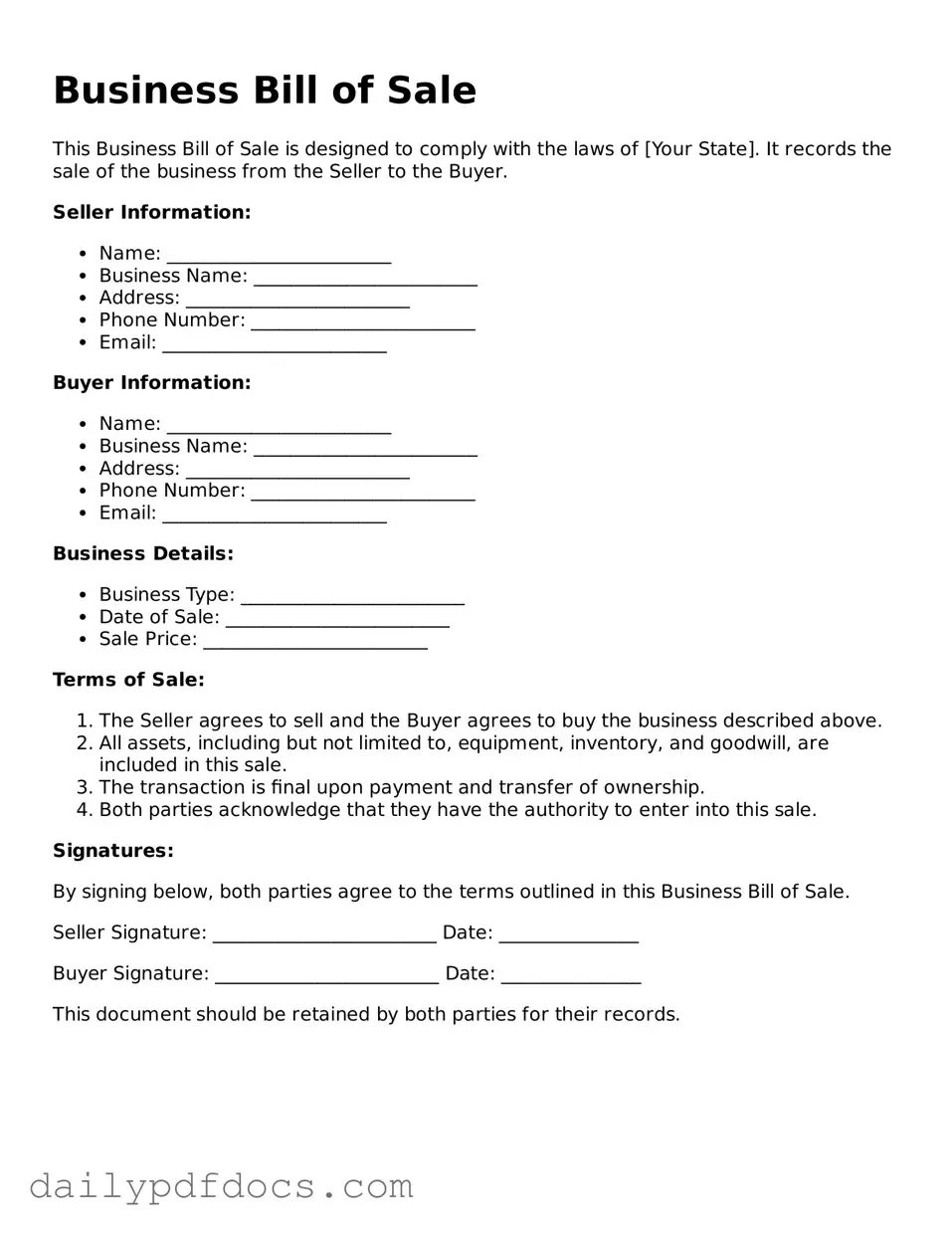

Preview - Business Bill of Sale Form

Business Bill of Sale

This Business Bill of Sale is designed to comply with the laws of [Your State]. It records the sale of the business from the Seller to the Buyer.

Seller Information:

- Name: ________________________

- Business Name: ________________________

- Address: ________________________

- Phone Number: ________________________

- Email: ________________________

Buyer Information:

- Name: ________________________

- Business Name: ________________________

- Address: ________________________

- Phone Number: ________________________

- Email: ________________________

Business Details:

- Business Type: ________________________

- Date of Sale: ________________________

- Sale Price: ________________________

Terms of Sale:

- The Seller agrees to sell and the Buyer agrees to buy the business described above.

- All assets, including but not limited to, equipment, inventory, and goodwill, are included in this sale.

- The transaction is final upon payment and transfer of ownership.

- Both parties acknowledge that they have the authority to enter into this sale.

Signatures:

By signing below, both parties agree to the terms outlined in this Business Bill of Sale.

Seller Signature: ________________________ Date: _______________

Buyer Signature: ________________________ Date: _______________

This document should be retained by both parties for their records.

Similar forms

- Vehicle Bill of Sale: This document transfers ownership of a vehicle from one party to another. It includes details about the vehicle, such as make, model, and VIN, similar to how a Business Bill of Sale outlines the business being sold.

- Personal Property Bill of Sale: This form is used to sell personal items, such as furniture or electronics. Like the Business Bill of Sale, it provides a record of the transaction and details about the items sold.

- Real Estate Purchase Agreement: This document outlines the terms of a real estate sale. It details the property involved and the agreement between buyer and seller, paralleling the Business Bill of Sale in its purpose of formalizing a sale.

- Equipment Bill of Sale: This is used to transfer ownership of equipment, often in business contexts. It shares similarities with the Business Bill of Sale by specifying the equipment details and sale terms.

- Asset Purchase Agreement: This document is used when a buyer purchases specific assets of a business rather than the entire business. It includes terms and conditions, much like the Business Bill of Sale.

- Inventory Bill of Sale: This form details the sale of inventory items. It provides information about the items being sold, akin to how a Business Bill of Sale lists the assets of a business.

- Stock Transfer Agreement: This document is used to transfer ownership of shares in a corporation. It includes details about the stock being transferred, similar to how a Business Bill of Sale specifies business ownership.

- Partnership Dissolution Agreement: This document outlines the terms of ending a partnership. It can include the sale of business interests, paralleling the Business Bill of Sale in its focus on business ownership changes.

- Mobile Home Bill of Sale: This document is essential for transferring ownership of a mobile home, providing necessary details about the buyer, seller, and property. For more information, refer to mobilehomebillofsale.com/blank-new-york-mobile-home-bill-of-sale/.

- Lease Assignment: This document allows one party to transfer their lease rights to another. It shares a focus on the transfer of rights, similar to how a Business Bill of Sale transfers ownership of a business.

- Franchise Agreement: This document establishes the terms of a franchise relationship. It includes details about the business being franchised, similar to how a Business Bill of Sale outlines the business being sold.

Misconceptions

The Business Bill of Sale form is an essential document for anyone looking to buy or sell a business. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this important form.

-

It is only necessary for large businesses.

This is not true. A Business Bill of Sale is important for businesses of all sizes. Whether you are selling a small local shop or a large corporation, documenting the sale protects both parties.

-

It can be verbal.

While verbal agreements can occur, they are not legally binding in the same way a written document is. A Business Bill of Sale provides clear evidence of the transaction and its terms.

-

It is the same as a contract.

Though related, a Business Bill of Sale is not a contract. It specifically documents the transfer of ownership, while a contract outlines the terms of the agreement.

-

It does not need to be notarized.

In many cases, notarization is not a requirement. However, having the document notarized can add an extra layer of protection and authenticity.

-

It only covers physical assets.

This misconception overlooks the fact that a Business Bill of Sale can also include intangible assets, such as trademarks or customer lists, depending on the sale's terms.

-

It is only for the seller's protection.

In reality, the Business Bill of Sale protects both the buyer and the seller. It ensures that both parties have a record of the transaction and its details.

-

Once signed, it cannot be changed.

While it is best to finalize all terms before signing, amendments can be made if both parties agree. Just make sure to document any changes properly.

-

It is not needed if there is a lease involved.

Even if a business operates under a lease, a Business Bill of Sale is still necessary to document the transfer of ownership of the business itself.

-

It is a one-size-fits-all document.

This is a misconception. Each Business Bill of Sale should be tailored to the specific transaction and the assets involved. Customization ensures that all relevant details are accurately captured.

Understanding these misconceptions can help individuals navigate the complexities of buying or selling a business. Clarity in the process is crucial for a smooth transaction.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This form serves to provide proof of the transaction and outlines the terms agreed upon by both the buyer and the seller. |

| Governing Law | Each state has its own laws governing the sale of business assets. For example, California follows the Uniform Commercial Code (UCC) for such transactions. |

| Required Information | The form typically includes details about the buyer, seller, description of the business or assets, sale price, and date of transfer. |

| Signatures | Both parties must sign the document to make it legally binding. Notarization may be required in some states. |