Fill Your Auto Insurance Card Form

The Auto Insurance Card form is a crucial document for vehicle owners, serving as proof of insurance coverage. This card contains essential information that both the insured and law enforcement must be aware of in case of an accident. Key details include the insurance identification number, the policy number, and the effective and expiration dates of the coverage. Additionally, it lists the make and model of the vehicle, along with its Vehicle Identification Number (VIN). The agency or company issuing the card is also identified. It is important to note that the card must be kept in the insured vehicle at all times and presented upon request during an accident. Furthermore, the card provides guidance on what to do following an accident, including collecting information from all parties involved. An artificial watermark is present on the front of the document, which can be viewed by holding the card at an angle. This form not only serves as a legal requirement but also plays a vital role in ensuring that drivers are prepared in the event of an incident.

Find Other Documents

96 Well Plate Dimensions - Ideal for high-throughput screening.

For those considering a transition in their marital status, an important resource is the detailed Marital Separation Agreement guide, which assists in understanding how this agreement can facilitate asset division and custody arrangements.

Cash Drawer Balance Sheet - Enhance the efficiency of cash registers.

How Do I Get My P45 - It is important for employees to track and manage their P45 for any potential tax refunds.

Common Questions

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have active insurance coverage for your vehicle. It contains essential information, such as your insurance company’s name, policy number, and the vehicle’s details. You must keep this card in your vehicle at all times.

What information is included on the Auto Insurance Card?

The card includes several key pieces of information: the insurance company’s name, your policy number, effective and expiration dates, the year, make, and model of your vehicle, and the Vehicle Identification Number (VIN). Additionally, the card will show the agency or company that issued it.

Why is it important to keep the Auto Insurance Card in the vehicle?

It is important to keep the Auto Insurance Card in your vehicle because you must present it upon demand in case of an accident or traffic stop. Law enforcement and other parties involved may require proof of insurance to verify that you are covered.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card. It’s essential to have a valid card to avoid penalties or complications if you are stopped by law enforcement.

What should I do if I get into an accident?

In the event of an accident, report it to your insurance agent or company as soon as possible. Collect the names and addresses of all drivers, passengers, and witnesses involved. Also, note the insurance company names and policy numbers for each vehicle involved in the accident.

What does the artificial watermark on the card signify?

The artificial watermark on the Auto Insurance Card is a security feature. To view it, hold the card at an angle. This watermark helps prevent fraud and ensures that the card is genuine.

Can I use a digital version of the Auto Insurance Card?

Some states allow digital versions of the Auto Insurance Card. Check your state’s laws to confirm if a digital card is acceptable. If allowed, ensure that your digital card is easily accessible on your smartphone or device.

What happens if my insurance policy expires?

If your insurance policy expires, you will no longer have valid coverage for your vehicle. It is crucial to renew your policy before the expiration date to avoid any gaps in coverage. Driving without insurance can lead to legal penalties and financial liability.

How can I update the information on my Auto Insurance Card?

To update information on your Auto Insurance Card, contact your insurance agent or company. They can provide a new card reflecting any changes, such as a new vehicle or updated policy details. Always ensure that your card has the most current information.

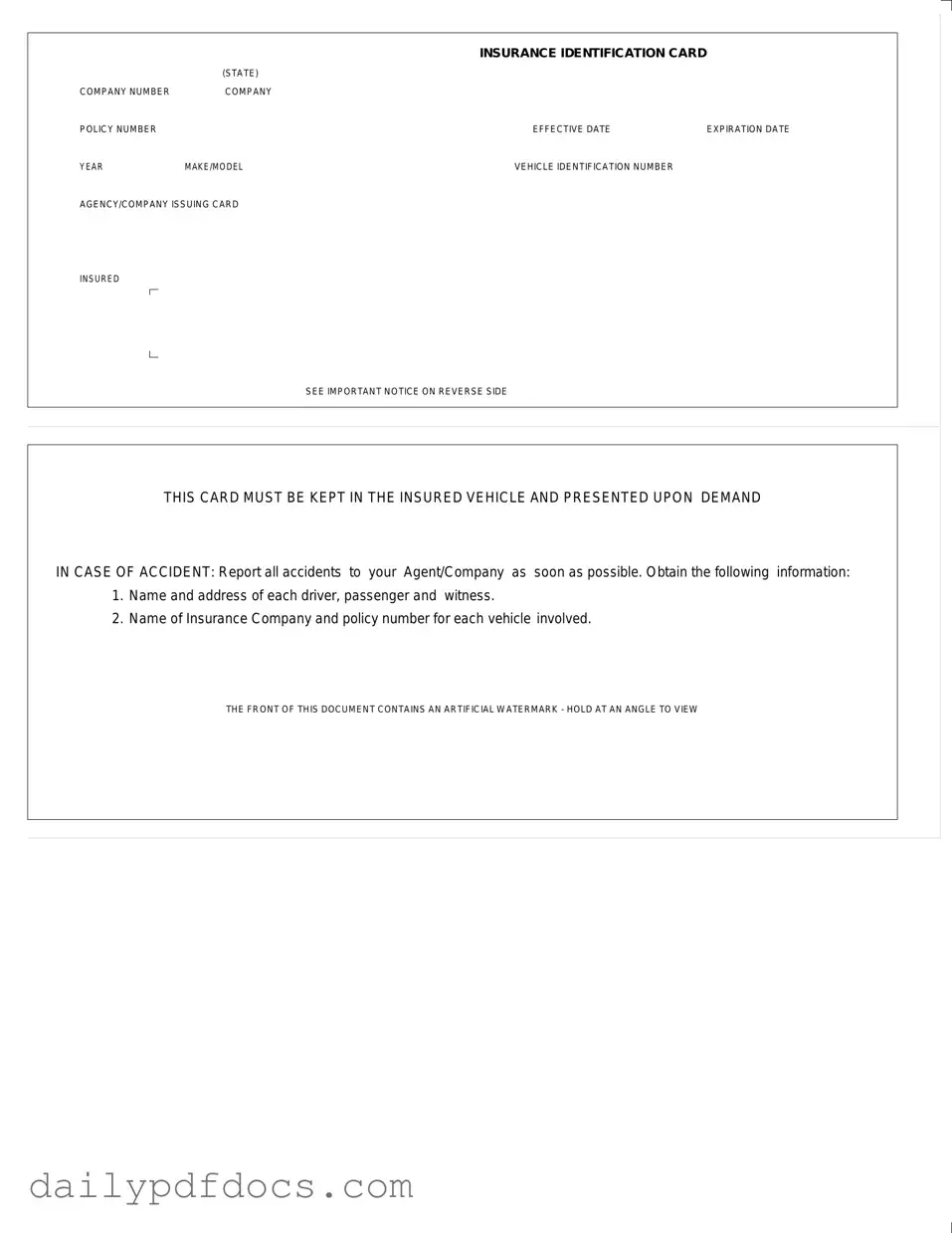

Preview - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Similar forms

Proof of Insurance Certificate: This document serves as verification that a vehicle is insured. Like the Auto Insurance Card, it includes the policyholder's information, policy number, and effective dates. Both documents must be presented in case of an accident.

Vehicle Registration: The vehicle registration document provides proof of ownership and includes details such as the vehicle identification number (VIN) and make/model. Similar to the Auto Insurance Card, it must be kept in the vehicle and shown upon request.

- Property Transfer Deed Form: For those engaged in real estate transactions, our essential property transfer deed form guide ensures accurate and legal documentation during the ownership transfer process.

Insurance Policy Declaration Page: This page outlines the coverage details of an insurance policy. It includes the policyholder's name, effective dates, and coverage limits. Like the Auto Insurance Card, it is essential for understanding your insurance coverage.

Rental Car Agreement: When renting a vehicle, this document outlines the terms of the rental, including insurance coverage options. Similar to the Auto Insurance Card, it is crucial for ensuring you have the necessary insurance while driving a rental vehicle.

Accident Report Form: This form is used to document the details of an accident. It requires information about all parties involved, similar to the instructions on the Auto Insurance Card regarding gathering information after an accident.

Misconceptions

Misconceptions about the Auto Insurance Card form can lead to confusion regarding its purpose and requirements. Below are five common misconceptions along with clarifications.

- The card is only necessary for accidents. Many believe that the auto insurance card is only required when an accident occurs. In reality, it must be kept in the insured vehicle at all times and presented upon demand by law enforcement or other parties.

- All information on the card is optional. Some individuals think that they can ignore certain details on the card. However, critical information such as the company number, policy number, and vehicle identification number must be accurate and complete.

- The card is valid indefinitely. It is a common misconception that once an auto insurance card is issued, it remains valid forever. In fact, the card includes an expiration date, indicating when coverage must be renewed or updated.

- Only the primary driver needs to carry the card. Many assume that only the primary driver of the vehicle needs to have the insurance card. However, any authorized driver operating the vehicle should be able to present the card if requested.

- The watermark is just for decoration. Some people believe that the watermark on the card is merely a design feature. In truth, it serves as a security measure to help verify the authenticity of the document.

File Attributes

| Fact Name | Details |

|---|---|

| Document Type | This is an Insurance Identification Card. |

| State-Specific | The card is issued according to state regulations. |

| Company Number | The card includes a unique company number for identification. |

| Policy Number | A policy number specific to the insured vehicle is provided. |

| Effective Date | The card displays the date when the insurance coverage begins. |

| Expiration Date | The card indicates when the insurance coverage will end. |

| Vehicle Details | Year, make, model, and vehicle identification number (VIN) are listed. |

| Issuing Agency | The name of the agency or company that issued the card is included. |

| Important Notice | The card must be kept in the insured vehicle and presented upon demand. |