Free Articles of Incorporation Template

When starting a business, one of the first steps is to establish a legal entity, and the Articles of Incorporation form plays a crucial role in this process. This essential document outlines the basic information about the corporation, including its name, purpose, and duration. Additionally, it specifies the number of shares the corporation is authorized to issue, which is vital for potential investors. The form also identifies the registered agent, a designated individual or business responsible for receiving legal documents on behalf of the corporation. Furthermore, it may require details about the incorporators—those who are forming the corporation—and any other provisions that the founders wish to include. By completing and filing the Articles of Incorporation with the appropriate state authority, entrepreneurs can officially create their corporation, paving the way for growth and legal protection in the business world.

Find Common Templates

Form 1098 - Get acquainted with your overall debt balance through this monthly report.

In Washington, submitting the Homeschool Letter of Intent is vital for families embarking on the homeschooling journey, as it formally informs the state of their educational choice. By completing this essential form, families can ensure that their intent to homeschool is officially acknowledged. For those in need of guidance, a useful resource can be found at https://homeschoolintent.com/editable-washington-homeschool-letter-of-intent.

Ms Word Chart - Date: Consider adding a timestamp if relevant.

Problems With Transfer on Death Deeds California - The Transfer-on-Death Deed can help ensure your property is inherited by those you care about most.

Articles of Incorporation - Tailored for Individual States

Common Questions

What is the Articles of Incorporation form?

The Articles of Incorporation form is a legal document that establishes a corporation in the United States. This document outlines basic information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form with the appropriate state authority is a crucial step in the incorporation process.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is essential for legally establishing a corporation. This document provides the state with information about your business and protects your personal assets by creating a separate legal entity. It also allows your corporation to enter into contracts, own property, and conduct business under its own name.

What information is required on the Articles of Incorporation form?

The form typically requires the corporation's name, purpose, registered agent's name and address, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators. Some states may require additional information, such as the corporation's duration or specific provisions related to management.

How do I choose a name for my corporation?

When selecting a name, ensure it is unique and not already in use by another corporation in your state. The name must also comply with state naming rules, which often include restrictions on certain words and phrases. It’s advisable to check the state’s business registry to confirm availability before filing.

What is a registered agent?

A registered agent is an individual or business entity designated to receive legal documents on behalf of the corporation. This person must have a physical address in the state where the corporation is registered. The registered agent plays a vital role in ensuring that the corporation receives important legal notices and documents in a timely manner.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation varies by state and can range from a few days to several weeks. Some states offer expedited processing for an additional fee. It’s important to check with the specific state authority for the most accurate timeline.

What are the fees associated with filing Articles of Incorporation?

Filing fees for Articles of Incorporation vary by state and can range from $50 to several hundred dollars. Additional fees may apply for expedited processing or for obtaining certified copies of the document. It’s advisable to review the fee schedule on the state’s business filing website.

Can I amend my Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if there are changes to your corporation’s structure, such as a change in the name, purpose, or registered agent. This typically requires filing an amendment form with the state and may involve additional fees.

Do I need to have a lawyer to file Articles of Incorporation?

While it is not legally required to have a lawyer to file Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that the document is completed accurately and in compliance with state laws, potentially saving you time and avoiding future legal issues.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the state will issue a certificate of incorporation. This document serves as proof that your corporation is legally established. You can then proceed with other necessary steps, such as obtaining an Employer Identification Number (EIN) and setting up corporate bylaws.

Preview - Articles of Incorporation Form

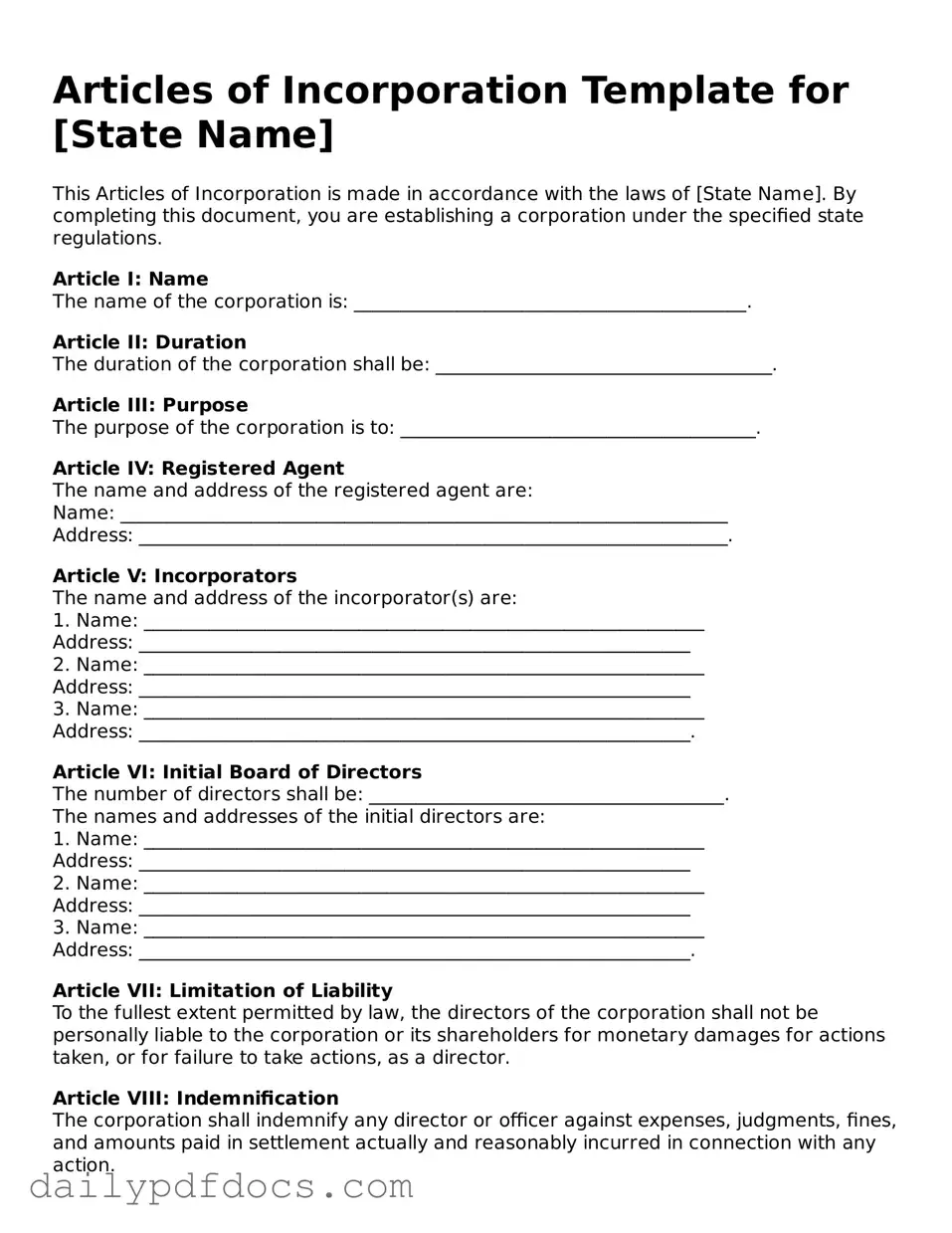

Articles of Incorporation Template for [State Name]

This Articles of Incorporation is made in accordance with the laws of [State Name]. By completing this document, you are establishing a corporation under the specified state regulations.

Article I: Name

The name of the corporation is: __________________________________________.

Article II: Duration

The duration of the corporation shall be: ____________________________________.

Article III: Purpose

The purpose of the corporation is to: ______________________________________.

Article IV: Registered Agent

The name and address of the registered agent are:

Name: _________________________________________________________________

Address: _______________________________________________________________.

Article V: Incorporators

The name and address of the incorporator(s) are:

1. Name: ____________________________________________________________

Address: ___________________________________________________________

2. Name: ____________________________________________________________

Address: ___________________________________________________________

3. Name: ____________________________________________________________

Address: ___________________________________________________________.

Article VI: Initial Board of Directors

The number of directors shall be: ______________________________________.

The names and addresses of the initial directors are:

1. Name: ____________________________________________________________

Address: ___________________________________________________________

2. Name: ____________________________________________________________

Address: ___________________________________________________________

3. Name: ____________________________________________________________

Address: ___________________________________________________________.

Article VII: Limitation of Liability

To the fullest extent permitted by law, the directors of the corporation shall not be personally liable to the corporation or its shareholders for monetary damages for actions taken, or for failure to take actions, as a director.

Article VIII: Indemnification

The corporation shall indemnify any director or officer against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with any action.

Article IX: Amendments

These Articles may be amended by: ________________________________________.

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ___ day of ____________, 20__.

Incorporator Signature: _______________________________________________

Incorporator Name: _________________________________________________

Similar forms

Bylaws: Bylaws outline the internal rules and procedures for a corporation, similar to how Articles of Incorporation establish the corporation's existence and basic structure.

Operating Agreement: An operating agreement is used for LLCs and details the management structure and operating procedures, much like Articles of Incorporation do for corporations.

- Operating Agreement: For LLCs, the operating agreement is a vital document that governs management and ownership, akin to the Articles of Incorporation. Members should be familiar with its content to ensure clarity in roles and responsibilities, and it can be obtained through resources like Ohio PDF Forms.

Certificate of Formation: This document is often required for LLCs and serves a similar purpose to Articles of Incorporation by formally creating a business entity.

Partnership Agreement: A partnership agreement outlines the terms of a partnership, similar to how Articles of Incorporation define the framework for a corporation.

Business License: A business license grants permission to operate a business, much like Articles of Incorporation provide legal recognition to a corporation.

Shareholder Agreement: This agreement governs the relationship between shareholders and the corporation, paralleling how Articles of Incorporation establish the rights of shareholders.

Tax ID Application: Applying for a tax identification number is necessary for tax purposes, similar to how Articles of Incorporation are needed to establish a corporation legally.

Annual Report: An annual report provides updates on a corporation's activities and finances, which relates to the ongoing requirements set forth in the Articles of Incorporation.

Certificate of Good Standing: This document confirms that a corporation is compliant with state regulations, similar to the legal status granted by the Articles of Incorporation.

Amendment to Articles of Incorporation: This document modifies the original Articles of Incorporation, showing how changes can be made to the foundational document of a corporation.

Misconceptions

- Misconception 1: The Articles of Incorporation are only necessary for large businesses.

- Misconception 2: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 3: The Articles of Incorporation automatically grant tax-exempt status.

- Misconception 4: All states have the same requirements for Articles of Incorporation.

- Misconception 5: The Articles of Incorporation are the only document needed to start a corporation.

This is not true. Any business that wants to operate as a corporation, regardless of size, must file Articles of Incorporation. This document establishes the corporation's existence and outlines its basic structure.

In reality, corporations can amend their Articles of Incorporation. Changes may be necessary as the business evolves, and the process for making amendments is typically straightforward.

Filing Articles of Incorporation does not confer tax-exempt status. Corporations must apply separately for tax-exempt status through the IRS, meeting specific criteria to qualify.

This is a common misunderstanding. Each state has its own rules and requirements for filing Articles of Incorporation. It's essential to check the specific regulations in the state where the corporation is being formed.

While the Articles of Incorporation are crucial, they are not the only document required. Additional filings, such as bylaws and various permits, may also be necessary to fully establish a corporation.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation form establishes a corporation as a legal entity separate from its owners. |

| State-Specific Requirements | Each state has its own requirements for the Articles of Incorporation, including specific information that must be included. |

| Governing Laws | The governing laws for Articles of Incorporation vary by state. For example, in California, it is governed by the California Corporations Code. |

| Filing Process | After completing the form, it must be filed with the appropriate state agency, usually the Secretary of State, along with any required fees. |