Fill Your Adp Pay Stub Form

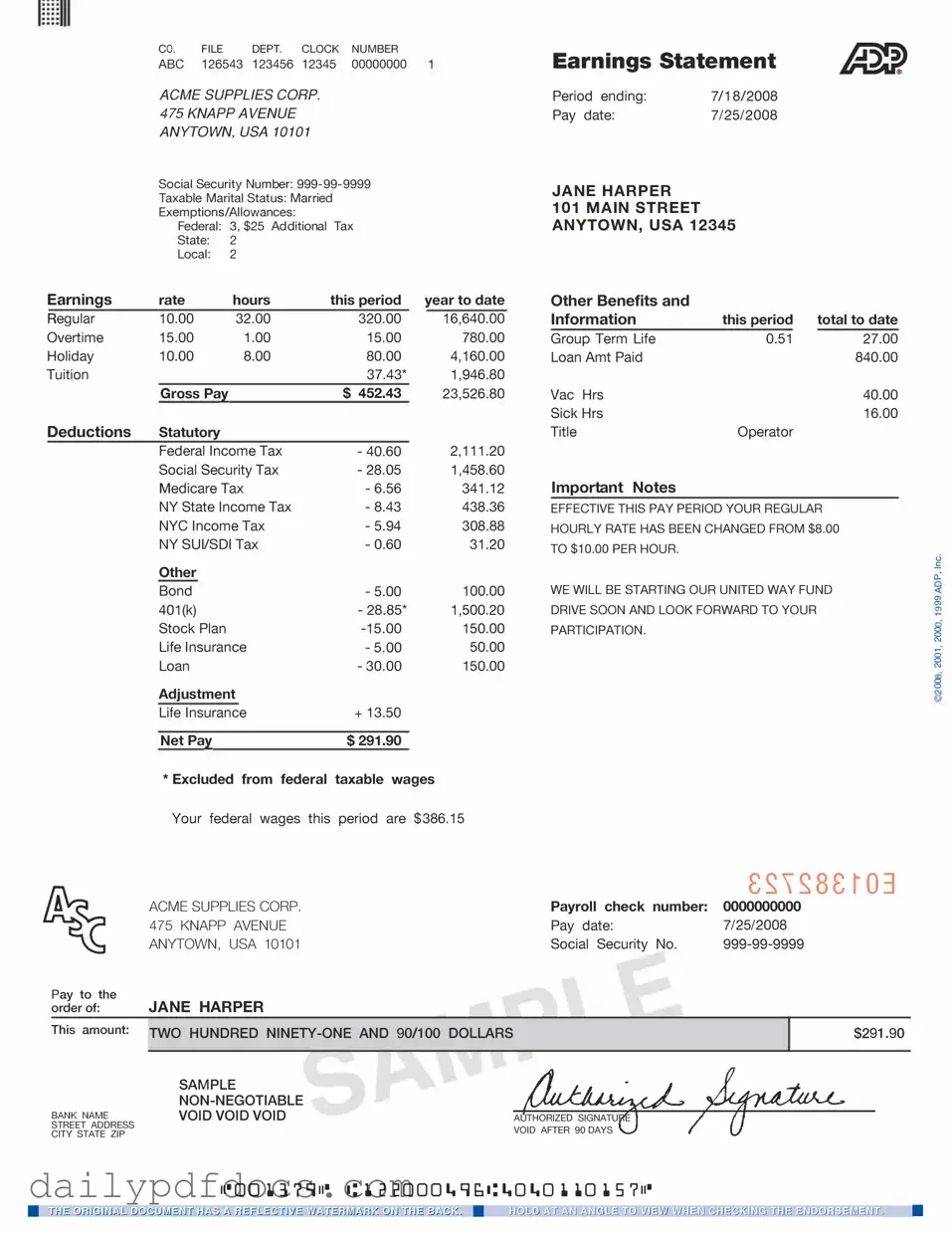

The ADP Pay Stub form is an essential document for employees and employers alike, providing a clear breakdown of earnings and deductions for each pay period. This form typically includes important details such as gross pay, net pay, taxes withheld, and contributions to benefits like health insurance and retirement plans. Understanding the various sections of the pay stub can help employees track their income, verify the accuracy of their pay, and plan their finances more effectively. Additionally, employers benefit from using this standardized form to ensure transparency and maintain compliance with payroll regulations. By reviewing the ADP Pay Stub, employees can gain insights into their financial health and make informed decisions about their spending and saving habits.

Find Other Documents

Simple Boyfriend Application Form - A DIY enthusiast who enjoys creating together.

What Is a W9 for a Business - Once a W-9 is submitted, it’s important to keep a copy for your records.

Common Questions

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It includes details such as gross pay, deductions, and net pay. Employees can use this information for budgeting, tax preparation, and verifying income for loans or other financial applications.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. Simply log in with your credentials. If you are a first-time user, you may need to create an account. Once logged in, navigate to the “Pay” section, where you can view and download your pay stubs. If you encounter any issues, your employer’s HR department can assist you.

What information is included in an ADP Pay Stub?

An ADP Pay Stub typically includes your employee information, pay period dates, gross earnings, various deductions (such as taxes, retirement contributions, and health insurance), and your net pay. It may also show year-to-date totals for earnings and deductions, which can be helpful for tracking your financial progress throughout the year.

What should I do if I find an error on my ADP Pay Stub?

If you notice an error on your ADP Pay Stub, it is important to address it promptly. First, double-check the details to ensure it’s indeed an error. Then, contact your employer’s payroll or HR department to report the issue. They can investigate and correct any discrepancies. Keeping a record of your communications can also be helpful.

Preview - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Similar forms

- Paycheck Stub: This document is similar to the ADP Pay Stub as it provides a breakdown of earnings and deductions for a specific pay period. It typically includes gross pay, net pay, and itemized deductions.

- W-2 Form: The W-2 form summarizes an employee's annual earnings and tax withholdings. While the ADP Pay Stub shows pay for a specific period, the W-2 provides a yearly overview.

- Direct Deposit Receipt: This document confirms that an employee's paycheck has been directly deposited into their bank account. Like the ADP Pay Stub, it details the amount deposited and any deductions.

- Payroll Summary Report: This report provides an overview of all payroll data for a specific period. It shares similarities with the ADP Pay Stub in terms of summarizing employee earnings and deductions.

- 1099 Form: For independent contractors, the 1099 form reports earnings and tax information. While it differs in context, it serves a similar purpose of documenting income, much like the ADP Pay Stub does for employees.

- Time Card: A time card tracks hours worked by an employee. Though it does not include financial details, it is a crucial document that supports the information reflected in the ADP Pay Stub.

Employment Verification Form: This essential document confirms an individual's employment status and history in California. For a reliable template to assist you in creating your own verification form, visit Top Document Templates.

- Commission Statement: For employees earning commissions, this document outlines commission earnings for a specific period. It relates to the ADP Pay Stub by providing additional income details.

- Benefits Statement: This document lists the benefits an employee is enrolled in and their costs. It complements the ADP Pay Stub by detailing deductions related to benefits.

- Employment Verification Letter: This letter confirms an employee's job status and salary. While it serves a different purpose, it may reference information found on the ADP Pay Stub.

Misconceptions

Understanding the ADP Pay Stub form is crucial for employees and employers alike. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about the ADP Pay Stub form:

-

All deductions are the same for every employee.

This is not true. Deductions vary based on individual circumstances, such as tax filing status, benefits selected, and state regulations.

-

The pay stub only reflects gross pay.

In reality, the pay stub shows both gross pay and net pay. Gross pay is the total earnings before deductions, while net pay is what employees take home after all deductions.

-

Pay stubs are not important.

This misconception can lead to significant issues. Pay stubs provide essential information for tax filing, loan applications, and verifying income.

-

All deductions are mandatory.

Some deductions, like certain retirement contributions or health benefits, may be optional. Employees should review their choices to understand what is being deducted.

-

Pay stubs are only for full-time employees.

This is incorrect. Part-time employees also receive pay stubs, which detail their earnings and deductions, just like full-time employees.

-

Understanding the pay stub is not necessary.

Failing to understand the pay stub can lead to financial mismanagement. Knowing how to read it helps employees track their earnings and deductions accurately.

-

Employers can change pay stub formats at will.

While employers have some flexibility, they must comply with state laws regarding the information that must be included on pay stubs.

-

Pay stubs are the same as W-2 forms.

Pay stubs and W-2 forms serve different purposes. Pay stubs provide a snapshot of earnings for a specific pay period, while W-2 forms summarize annual earnings and tax withholdings.

By dispelling these misconceptions, employees can better understand their pay stubs and make informed decisions regarding their finances.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | This form typically includes information such as gross wages, taxes withheld, benefits deductions, and net pay. |

| Frequency | Employees may receive their pay stubs on a bi-weekly or monthly basis, depending on the employer's payroll schedule. |

| Accessibility | ADP offers electronic pay stubs, which can be accessed online through their secure employee portal, making it convenient for users. |

| State Compliance | Employers must comply with state-specific laws regarding pay stubs, which may require additional information to be included, such as hours worked in some states. |

| Record Keeping | Employees are encouraged to keep their pay stubs for personal records and tax purposes, as they provide essential information for financial planning. |

| Governing Laws | In states like California, employers must adhere to the California Labor Code, which mandates specific details on pay stubs, including the employee's name and the pay period. |